Intro

Master your Chase account with 5 expert statement tips, including online access, paperless statements, and transaction tracking, to streamline banking and stay organized with digital tools and services.

Understanding and managing your Chase statement is crucial for keeping track of your finances, ensuring you're not overspending, and catching any potential errors or fraudulent activities early. Chase, like many banks, offers detailed statements that can help you monitor your account activity. Here are some tips to make the most out of your Chase statement, along with an in-depth look at how to navigate and utilize the information provided.

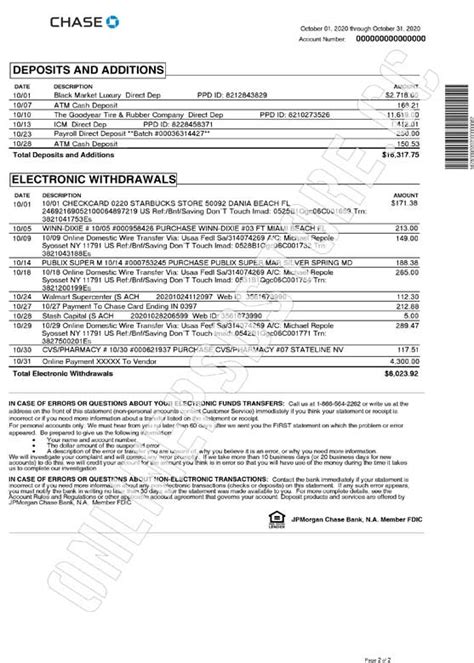

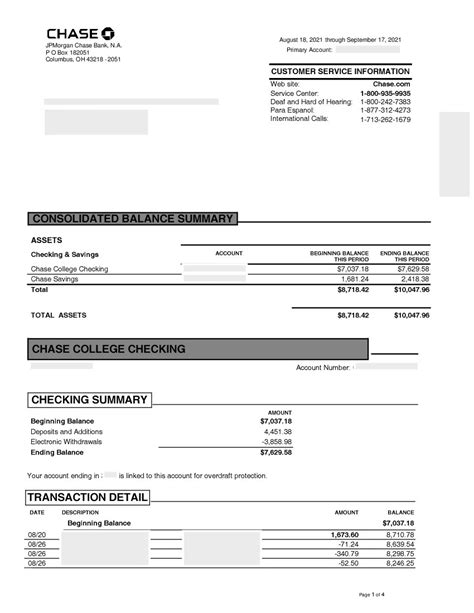

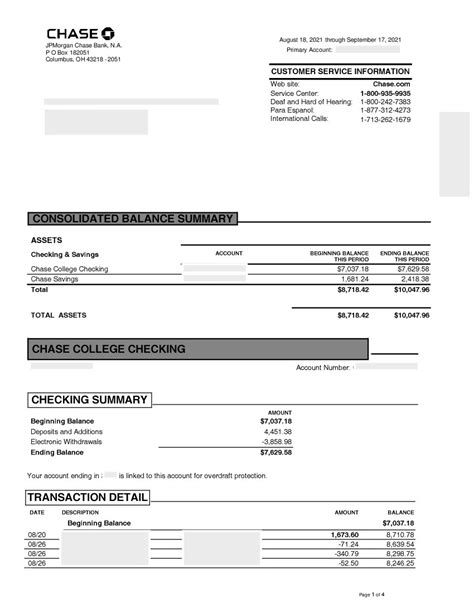

Firstly, it's essential to understand the components of your Chase statement. Typically, a statement will include your account information, the statement period, a list of all transactions (deposits and withdrawals), your beginning and ending balances, and any interest earned or fees charged. Knowing how to read and interpret this information is key to financial management.

Secondly, keeping your Chase statement organized, whether digitally or in physical form, can help you quickly locate specific transactions or periods of activity. This can be particularly useful for budgeting, tracking expenses, or during tax season when you might need to reference specific financial transactions.

Thirdly, regularly reviewing your Chase statement can help you identify any discrepancies or unauthorized transactions. This proactive approach to financial security can save you from potential fraud and help you maintain control over your accounts.

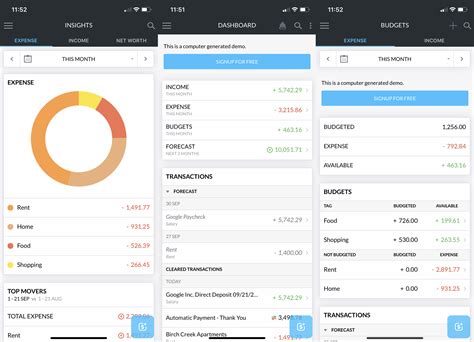

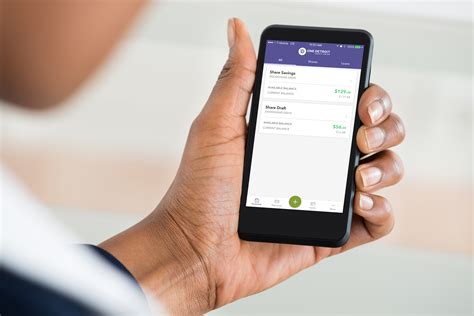

Lastly, leveraging the digital tools provided by Chase can enhance your statement experience. From mobile banking apps to online platforms, these tools offer features like transaction categorization, budgeting assistance, and real-time alerts that can help you stay on top of your finances.

Understanding Your Chase Statement

To truly benefit from your Chase statement, it's crucial to understand each component and how it contributes to your overall financial picture. This includes recognizing the different types of transactions (such as direct deposits, debit card purchases, and checks), understanding how interest is calculated and applied, and being aware of any fees associated with your account.

Breaking Down the Components

- **Account Information**: This section typically includes your account number, the type of account, and your address. It's essential to verify that this information is accurate to ensure you're receiving the correct statements and to prevent any mix-ups. - **Statement Period**: This indicates the time frame covered by the statement. Understanding the statement period can help you keep track of your spending habits over time and make informed decisions about your financial planning. - **Transactions**: This is a detailed list of all the activity on your account during the statement period, including deposits, withdrawals, and any transfers. Regularly reviewing this section can help you stay aware of your account activity and catch any errors or unauthorized transactions. - **Beginning and Ending Balances**: These show the balance at the start and end of the statement period. Monitoring these balances can help you understand how your account activity affects your overall financial standing.Organizing Your Statements

Effective organization of your Chase statements, whether you prefer physical copies or digital records, is vital for easy access to your financial information. Here are a few tips to consider:

- Digital Storage: Consider scanning your physical statements and saving them digitally. This not only saves space but also makes it easier to search for specific transactions or periods.

- Folder Organization: If you prefer physical copies, organize your statements in a folder or file cabinet. Label each folder with the statement period for easy reference.

- Secure Storage: Ensure that your statements, especially if they contain sensitive information, are stored securely. For digital copies, use password-protected folders or encrypted storage. For physical copies, consider a safe or a locked file cabinet.

Benefits of Organization

- **Easy Access**: Organized statements make it easier to find specific information when you need it. - **Financial Planning**: Being able to quickly review your past financial activity can inform your future financial decisions. - **Security**: Proper storage, especially of sensitive information, can protect you from identity theft and financial fraud.Reviewing for Discrepancies

Regularly reviewing your Chase statement for discrepancies or unauthorized transactions is a critical step in maintaining the security of your account. Here's how you can do it effectively:

- Check Transactions: Go through each transaction listed on your statement. Verify that you recognize each transaction and that the amounts are correct.

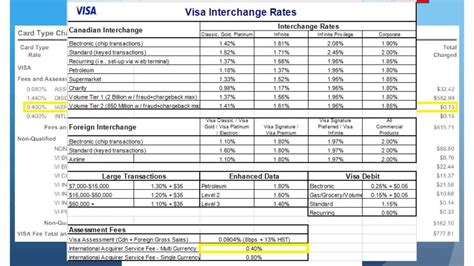

- Monitor Fees: Ensure that any fees charged to your account are legitimate. If you notice any unfamiliar fees, contact Chase immediately.

- Report Discrepancies: If you find any errors or unauthorized transactions, report them to Chase as soon as possible. They can help you resolve the issue and protect your account.

Importance of Prompt Action

- **Prevents Further Fraud**: Quick action can prevent further unauthorized transactions. - **Protects Your Credit**: Resolving discrepancies promptly can help protect your credit score from being negatively affected. - **Maintains Trust**: Regularly reviewing your statement and addressing any issues helps maintain trust in your banking relationship.Leveraging Digital Tools

Chase offers a variety of digital tools designed to make managing your finances easier and more convenient. These tools can help you get the most out of your Chase statement and improve your overall financial management.

- Mobile Banking App: The Chase mobile app allows you to view your account activity, transfer funds, and even deposit checks remotely.

- Online Banking: Chase's online platform provides detailed account information, including statements, and offers tools for budgeting and tracking expenses.

- Alerts: You can set up alerts for low balances, large transactions, and other activity to help you stay on top of your account security.

Benefits of Digital Tools

- **Convenience**: Digital tools make it easy to manage your finances from anywhere. - **Real-Time Information**: You can access your account information and view transactions in real-time. - **Enhanced Security**: Features like alerts and two-factor authentication can enhance the security of your account.Gallery of Chase Statement Tips

Chase Statement Image Gallery

Frequently Asked Questions

How do I access my Chase statement online?

+To access your Chase statement online, log in to your Chase online account, navigate to the "Account Activity" or "Statements" section, and select the statement period you wish to view.

Can I receive my Chase statement electronically?

+What should I do if I find an error on my Chase statement?

+If you find an error on your Chase statement, contact Chase customer service immediately. They will guide you through the process of resolving the issue and correcting your statement.

In conclusion, making the most of your Chase statement involves understanding its components, keeping it organized, regularly reviewing it for discrepancies, and leveraging the digital tools available to you. By following these tips and staying engaged with your financial activity, you can better manage your finances, enhance your account security, and make informed decisions about your financial future. We invite you to share your experiences or tips on managing Chase statements in the comments below and to explore more articles on financial management and security.