Intro

Master personal finance with 5 ways Excel budget templates simplify financial planning, tracking expenses, and money management, using spreadsheets, formulas, and budgeting tools.

Creating a budget is an essential step in managing personal finances effectively. It helps individuals track their income and expenses, make smart financial decisions, and achieve long-term financial goals. One of the most popular tools for creating a budget is Microsoft Excel, due to its versatility, flexibility, and ability to handle complex calculations. Excel offers a wide range of features that can be leveraged to create a comprehensive and personalized budget. Here are five ways Excel can be used to create an effective budget.

Excel is widely recognized for its ability to handle numerical data, making it an ideal platform for budgeting. Its spreadsheet layout allows users to organize their financial data into categories, such as income, fixed expenses, variable expenses, and savings. This organization enables users to have a clear overview of their financial situation at a glance. Furthermore, Excel's formulas and functions can be used to automate calculations, such as totaling income and expenses, calculating percentages, and projecting future financial scenarios.

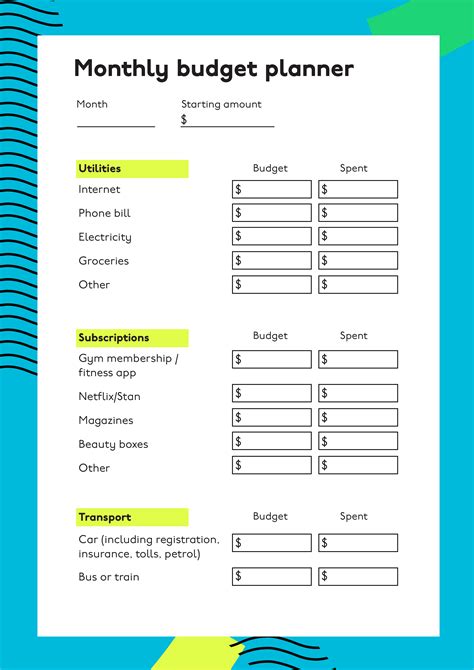

1. Budget Templates

One of the easiest ways to start creating a budget in Excel is by using pre-designed budget templates. These templates are available within Excel or can be downloaded from Microsoft's website and other online sources. Budget templates come with pre-set categories and formulas, which can be customized to fit individual needs. They save time and effort by providing a structured framework that users can fill in with their financial data. For beginners, using a template can be particularly helpful as it guides them through the budgeting process and ensures they consider all aspects of their financial situation.

2. Custom Budget Worksheets

For those who prefer a more personalized approach or have unique financial situations, creating a custom budget worksheet in Excel is a viable option. This involves setting up a spreadsheet from scratch, defining income and expense categories, and using Excel formulas to calculate totals and percentages. Custom worksheets allow for greater flexibility and can be tailored to include specific financial goals, such as saving for a down payment on a house, paying off debt, or building an emergency fund. Users can also incorporate conditional formatting to highlight areas where expenses exceed budgeted amounts, helping them stay on track.

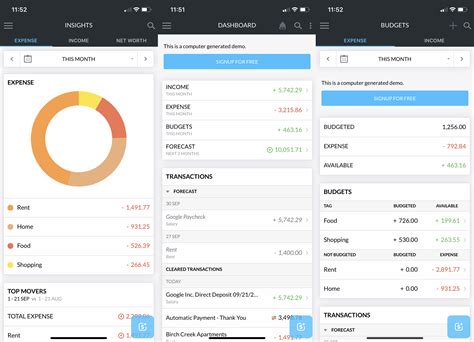

3. Budget Tracking and Analysis

Beyond creating a budget, Excel can be used to track actual income and expenses over time and compare them against the budget. This involves regularly updating the spreadsheet with new financial data and using tools like charts and graphs to visualize spending patterns and trends. Excel's analytical capabilities, including pivot tables and what-if analyses, can help identify areas where spending can be optimized, pinpoint financial leaks, and forecast future financial health. Regular tracking and analysis are crucial for making informed financial decisions and adjusting the budget as needed to stay on course with long-term financial objectives.

4. Automated Budgeting with Macros

For advanced users, Excel macros can automate repetitive budgeting tasks, such as data entry, calculations, and report generation. Macros are small programs that can be recorded or written in Visual Basic for Applications (VBA) to perform specific tasks. By automating these tasks, users can save time and reduce the risk of human error, making the budgeting process more efficient and reliable. Additionally, macros can be used to create custom budgeting tools and interfaces that simplify complex financial analysis and provide real-time insights into financial performance.

5. Collaborative Budgeting

Excel also facilitates collaborative budgeting, which is particularly useful for households with multiple income earners or for small businesses. By sharing an Excel budget spreadsheet, all parties can contribute to the budgeting process, ensuring that everyone is on the same page regarding financial goals and responsibilities. Features like Excel Online allow real-time co-authoring, enabling multiple users to edit the budget simultaneously from different locations. This collaborative approach promotes transparency, accountability, and a unified financial strategy.

Gallery of Budgeting Tools and Techniques

Budgeting Image Gallery

What are the benefits of using Excel for budgeting?

+Using Excel for budgeting offers several benefits, including the ability to create customized budgets, automate calculations, and track financial progress over time. It also provides a flexible and scalable platform for managing complex financial data.

How do I get started with creating a budget in Excel?

+To get started, you can use a pre-designed budget template or create your own custom worksheet. Define your income and expense categories, and use Excel formulas to calculate totals and percentages. Regularly update your spreadsheet with new financial data to track your progress.

Can I collaborate with others on an Excel budget?

+Yes, Excel allows for collaborative budgeting. You can share your budget spreadsheet with others, and features like Excel Online enable real-time co-authoring. This is particularly useful for households or small businesses where multiple individuals need to contribute to the budgeting process.

In conclusion, Excel offers a powerful and versatile platform for creating and managing a budget. Whether through the use of templates, custom worksheets, automated tracking, collaborative tools, or advanced analytical features, Excel can help individuals and businesses achieve their financial goals. By leveraging these capabilities, users can create a budget that is not only effective but also personalized to their unique financial situation and objectives. As financial management continues to evolve, the importance of having a reliable and adaptable tool like Excel cannot be overstated. We invite you to share your experiences with using Excel for budgeting, ask questions, or explore more topics related to personal finance and budgeting in the comments below.