Intro

Master ASC 842 compliance with our expert Lease Template Excel Guide, featuring lease accounting, amortization schedules, and financial reporting tools, streamlining lease management and audit prep.

The introduction of Accounting Standards Codification (ASC) 842 has brought significant changes to the way companies account for leases. The new standard, which was issued by the Financial Accounting Standards Board (FASB) in 2016, aims to increase transparency and comparability among companies by requiring lessees to recognize lease assets and liabilities on their balance sheets. To help companies navigate this complex standard, an ASC 842 lease template in Excel can be a valuable tool. In this article, we will explore the importance of ASC 842, its key components, and how an Excel template can facilitate compliance.

The implementation of ASC 842 has been a major undertaking for many companies, requiring significant time and resources. The standard applies to all leases with terms of 12 months or more, and it requires lessees to recognize a right-of-use (ROU) asset and a lease liability on their balance sheets. The ROU asset represents the lessee's right to use the underlying asset, while the lease liability represents the lessee's obligation to make lease payments. To accurately account for these transactions, companies need a robust system for tracking and managing their leases.

Understanding ASC 842

Key Components of ASC 842

Benefits of Using an ASC 842 Lease Template in Excel

The use of an ASC 842 lease template in Excel offers several benefits, including: * Improved accuracy and efficiency in tracking and managing leases * Enhanced visibility into lease assets and liabilities * Simplified calculations and reporting * Better decision-making through data analysis and insights * Compliance with ASC 842 requirementsCreating an ASC 842 Lease Template in Excel

Best Practices for Using an ASC 842 Lease Template in Excel

To get the most out of an ASC 842 lease template in Excel, companies should follow best practices, including: * Regularly reviewing and updating the template to ensure compliance with ASC 842 * Using clear and consistent naming conventions and formatting * Implementing data validation and error checking to ensure accuracy * Providing training and support to users * Continuously monitoring and evaluating the effectiveness of the templateCommon Challenges and Solutions

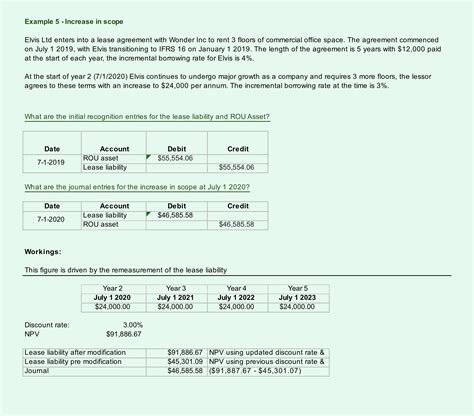

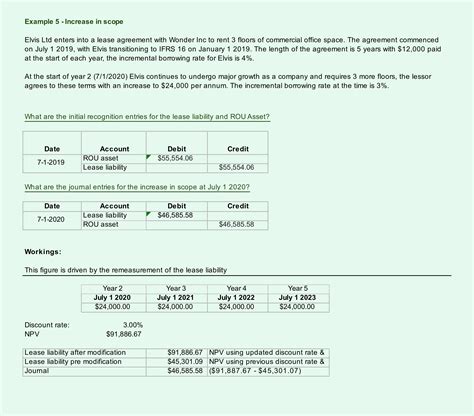

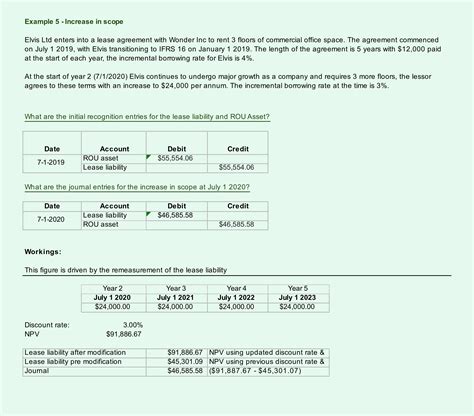

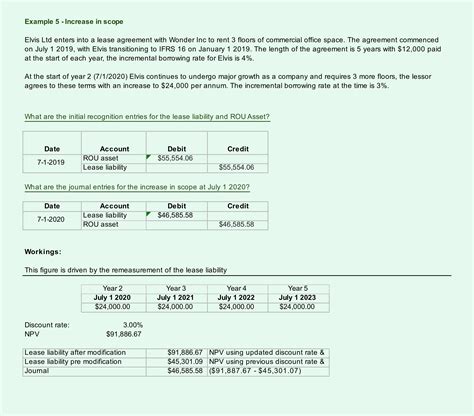

Case Study: Implementing ASC 842 at a Large Corporation

A large corporation with multiple leases across different locations faced significant challenges in implementing ASC 842. To address these challenges, the company developed an ASC 842 lease template in Excel to track and manage its leases, perform calculations, and generate reports. The template helped the company to improve accuracy and efficiency, enhance visibility into lease assets and liabilities, and simplify compliance with ASC 842 requirements.Gallery of ASC 842 Lease Templates

ASC 842 Lease Template Image Gallery

Frequently Asked Questions

What is ASC 842 and how does it affect my company?

+ASC 842 is a new accounting standard that requires companies to recognize lease assets and liabilities on their balance sheets. It affects companies that have leases with terms of 12 months or more, and it requires lessees to recognize a right-of-use (ROU) asset and a lease liability on their balance sheets.

How do I determine whether a contract is a lease under ASC 842?

+To determine whether a contract is a lease, you must assess whether the contract conveys the right to use a specific asset for a period of time in exchange for consideration. You must also consider whether the contract meets the definition of a lease and whether it is a finance lease or an operating lease.

What are the benefits of using an ASC 842 lease template in Excel?

+The benefits of using an ASC 842 lease template in Excel include improved accuracy and efficiency in tracking and managing leases, enhanced visibility into lease assets and liabilities, simplified calculations and reporting, and better decision-making through data analysis and insights.

How do I create an ASC 842 lease template in Excel?

+To create an ASC 842 lease template in Excel, you should identify the key components of the standard and design a template that meets your specific needs. The template should include fields for lease identification, classification, and measurement, as well as calculations for lease assets and liabilities.

What are the common challenges and solutions when implementing ASC 842?

+Common challenges when implementing ASC 842 include data collection, system integration, and process changes. To overcome these challenges, companies can use an ASC 842 lease template in Excel to streamline data collection and processing, integrate with existing systems, and facilitate process changes.

In