Intro

Master ASC 842 compliance with our expert Lease Excel Template Guide, featuring lease accounting, amortization schedules, and financial reporting tools, simplifying lease management and FASB standards implementation.

The Accounting Standards Codification (ASC) 842 lease standard, introduced by the Financial Accounting Standards Board (FASB), represents a significant shift in how companies account for leases. This standard requires lessees to recognize lease assets and liabilities on the balance sheet for all leases with terms of more than 12 months, among other changes. To help navigate these complexities, an ASC 842 lease Excel template can be a valuable tool. This guide will explore the importance of ASC 842, the components of an effective lease Excel template, and how to use such a template to ensure compliance with the new standard.

Implementing ASC 842 can be a daunting task, especially for companies with a large portfolio of leases. The standard's requirements for lease classification, lease term, and discount rate determination can be intricate. Moreover, the calculation of right-of-use (ROU) assets and lease liabilities involves several steps, including determining the present value of lease payments. An Excel template designed specifically for ASC 842 can simplify these calculations, provide a structured approach to lease accounting, and help ensure that all necessary steps are taken to comply with the standard.

The transition to ASC 842 also offers an opportunity for companies to review and optimize their leasing processes. By centralizing lease data and using a systematic approach to lease accounting, companies can gain better insights into their lease portfolios. This can lead to more informed decision-making about future leasing activities and potentially identify areas for cost savings. An ASC 842 lease Excel template is not just a compliance tool but also a strategic resource for lease management.

Understanding ASC 842

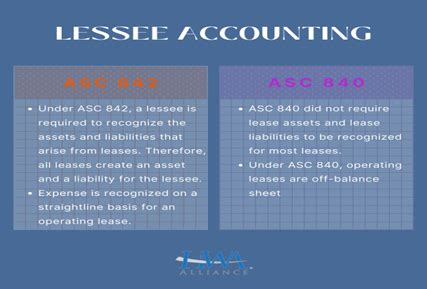

ASC 842 introduces significant changes to lease accounting for lessees. The standard eliminates the lease classification of leases as either capital or operating leases for lessees; instead, it requires that all leases be treated as finance leases (except for short-term leases). This means that lessees must recognize a right-of-use asset and a lease liability for virtually all leases. The only exceptions are short-term leases (those with terms of 12 months or less) and leases of intangible assets, among others. For lessors, the lease classification remains largely unchanged, with leases classified as sales-type leases, direct financing leases, or operating leases.

The implementation of ASC 842 requires a thorough understanding of the standard's requirements and the ability to apply these requirements to a company's specific lease portfolio. An ASC 842 lease Excel template can facilitate this process by providing pre-built formulas and structures for calculating lease assets and liabilities, determining lease classifications, and tracking lease terms and payments.

Components of an ASC 842 Lease Excel Template

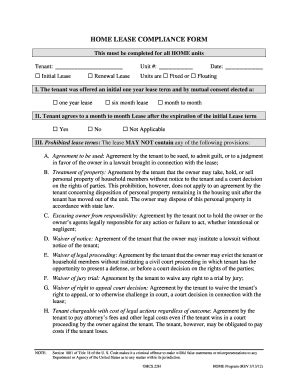

An effective ASC 842 lease Excel template should include several key components to ensure comprehensive lease accounting and compliance with the standard. These components may include:

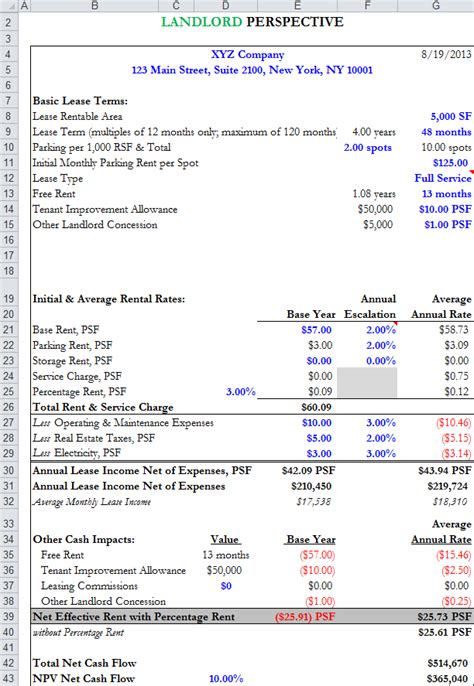

- Lease Input Sheet: A section where users can input lease details such as lease start and end dates, lease payments, discount rates, and lease terms.

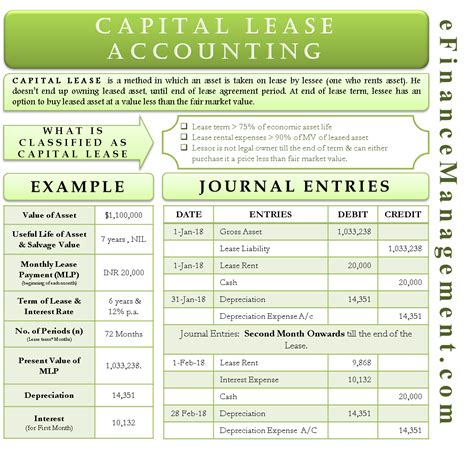

- Lease Classification Tool: A feature that helps determine the lease classification based on user inputs, such as the presence of a bargain purchase option, transfer of ownership, or if the lease term is for a major part of the asset's remaining economic life.

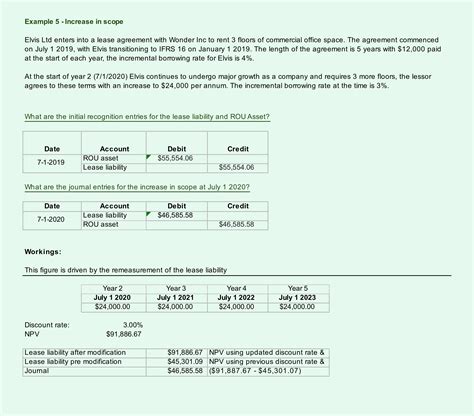

- ROU Asset and Lease Liability Calculator: Formulas to calculate the present value of lease payments, which is used to determine the initial ROU asset and lease liability.

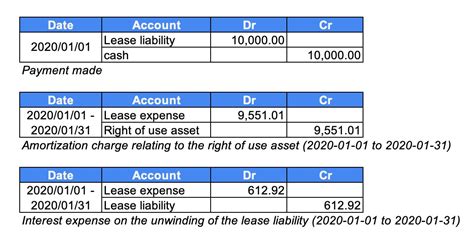

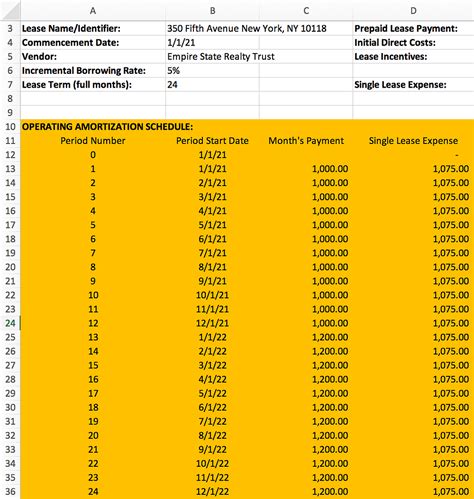

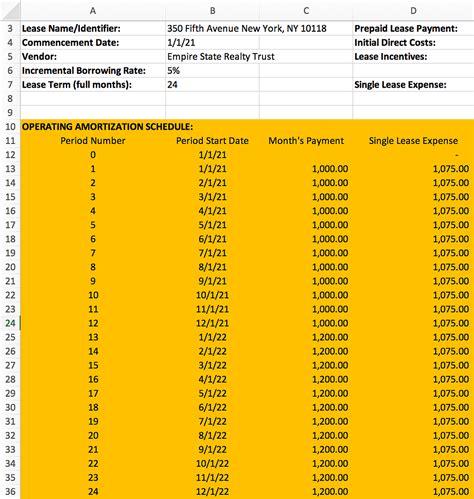

- Amortization Schedule: A table that outlines the amortization of the ROU asset and the accretion of the lease liability over the lease term.

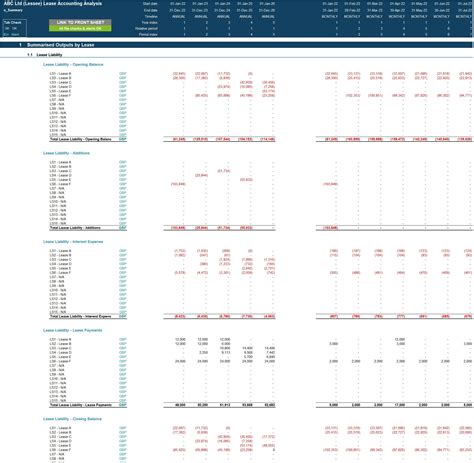

- Disclosure Requirements: Sections to track and summarize information necessary for the footnotes and disclosures required by ASC 842.

By organizing lease data and calculations in a structured and accessible way, an ASC 842 lease Excel template can significantly reduce the complexity and workload associated with implementing the new standard.

Using an ASC 842 Lease Excel Template

To effectively use an ASC 842 lease Excel template, follow these steps:

- Gather Lease Data: Collect all relevant lease information, including lease agreements, payment schedules, and any other details necessary for lease accounting under ASC 842.

- Input Lease Data: Enter the collected data into the template's input sheet, ensuring accuracy and completeness.

- Review and Adjust: Review the calculated ROU assets, lease liabilities, and amortization schedules. Adjust inputs as necessary to reflect the company's specific circumstances or to correct any errors.

- Monitor and Update: Regularly update the template with new lease information, changes to existing leases, or any other relevant updates to ensure ongoing compliance with ASC 842.

Benefits of Using an ASC 842 Lease Excel Template

The benefits of using an ASC 842 lease Excel template include:

- Simplified Compliance: The template helps ensure that all necessary calculations and disclosures are correctly prepared, reducing the risk of non-compliance.

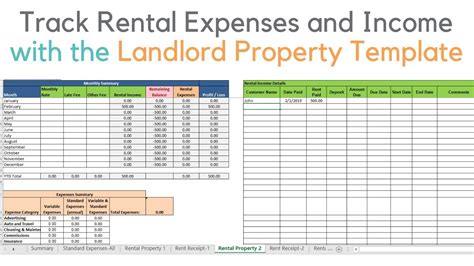

- Efficient Lease Management: Centralizing lease data and calculations in one place facilitates better management and analysis of the lease portfolio.

- Cost Savings: By streamlining lease accounting processes, companies can reduce the time and resources spent on compliance, potentially leading to cost savings.

Gallery of ASC 842 Lease Excel Templates

ASC 842 Lease Excel Template Gallery

Frequently Asked Questions

What is ASC 842?

+ASC 842 is a lease accounting standard introduced by the Financial Accounting Standards Board (FASB) that requires lessees to recognize lease assets and liabilities on the balance sheet for all leases with terms of more than 12 months.

How does ASC 842 affect lease accounting?

+ASC 842 eliminates the lease classification of leases as either capital or operating leases for lessees, requiring all leases to be treated as finance leases, except for short-term leases. This results in the recognition of right-of-use assets and lease liabilities on the balance sheet.

What are the benefits of using an ASC 842 lease Excel template?

+The benefits include simplified compliance with ASC 842, efficient lease management, and potential cost savings by streamlining lease accounting processes.

In conclusion, an ASC 842 lease Excel template is a powerful tool for companies navigating the complexities of the new lease accounting standard. By providing a structured approach to lease accounting, such a template can simplify compliance, enhance lease management, and offer strategic insights into a company's lease portfolio. As companies continue to adapt to ASC 842, leveraging the right tools and resources will be crucial for maintaining compliance and maximizing the benefits of the new standard. We invite you to share your experiences with ASC 842 and how you are using Excel templates or other tools to manage lease accounting. Your insights can help others in the financial community navigate this significant change in accounting standards.