Intro

Discover 5 ways to simplify ASC 842 lease amortization, including lease accounting, amortization schedules, and financial reporting, to ensure compliance and accuracy in lease accounting standards and financial disclosures.

The introduction of ASC 842 has brought significant changes to the way companies account for leases. One of the key aspects of this new standard is lease amortization, which can have a substantial impact on a company's financial statements. In this article, we will delve into the world of ASC 842 lease amortization, exploring its importance, benefits, and the various ways it can be applied.

The Financial Accounting Standards Board (FASB) introduced ASC 842 to increase transparency and comparability in financial reporting. The new standard requires companies to recognize lease assets and liabilities on their balance sheets, which can lead to a more accurate representation of a company's financial position. Lease amortization is a critical component of this process, as it helps companies to allocate the cost of a lease over its term.

Lease amortization can be complex, but it is essential for companies to understand its implications. The correct application of lease amortization can help companies to avoid errors in financial reporting, which can have serious consequences. In this article, we will explore five ways ASC 842 lease amortization can impact a company's financial statements and provide guidance on how to navigate this complex area.

Understanding ASC 842 Lease Amortization

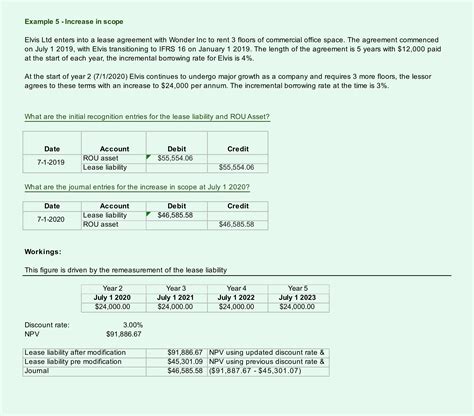

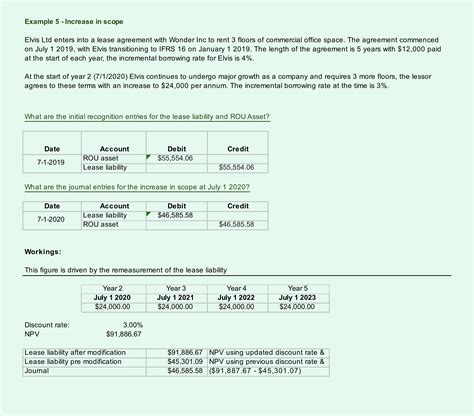

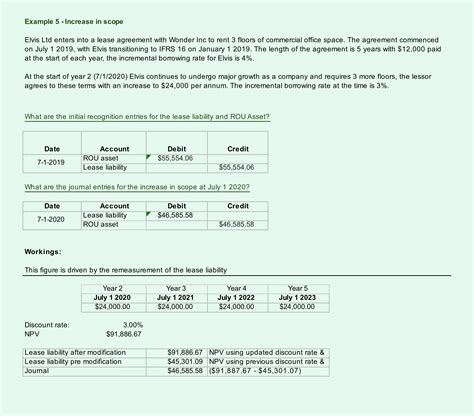

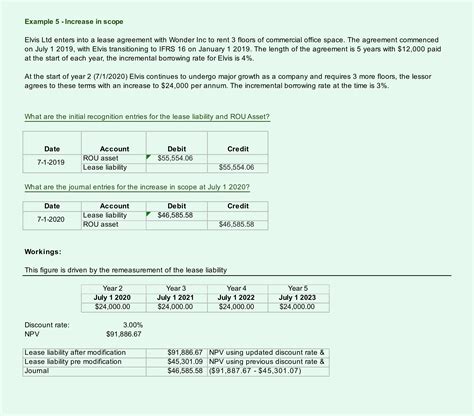

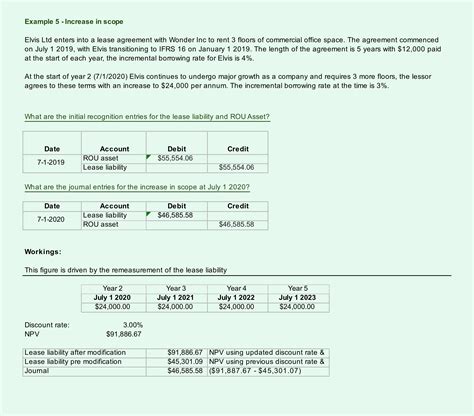

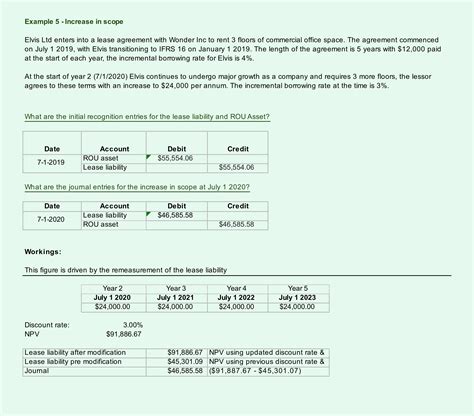

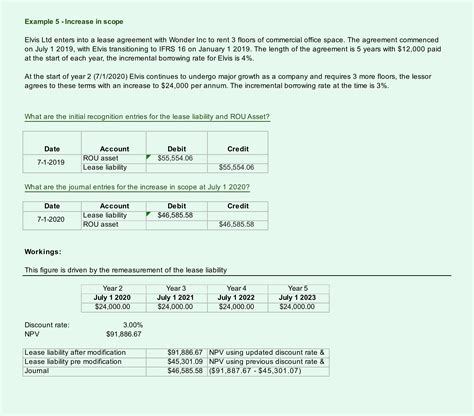

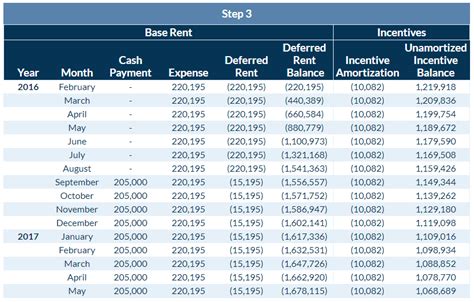

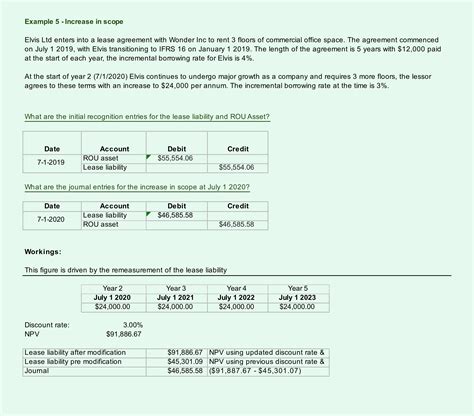

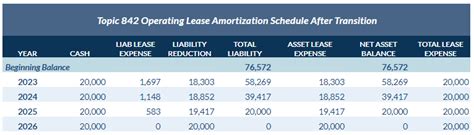

Lease amortization is the process of allocating the cost of a lease over its term. This is typically done using the effective interest method, which takes into account the lease liability and the right-of-use asset. The effective interest method requires companies to calculate the interest expense on the lease liability and the amortization of the right-of-use asset over the lease term.

Benefits of ASC 842 Lease Amortization

Another benefit of ASC 842 lease amortization is that it increases transparency in financial reporting. The new standard requires companies to disclose detailed information about their leases, including the lease term, lease payments, and discount rates. This increased transparency can help investors and analysts to make more informed decisions.

5 Ways ASC 842 Lease Amortization Can Impact Financial Statements

- Increased Expenses: ASC 842 lease amortization can lead to increased expenses on the income statement. This is because companies are required to recognize the amortization of the right-of-use asset and the interest expense on the lease liability over the lease term.

- Changes in Cash Flow: The new standard can also impact cash flow statements. Companies are required to classify lease payments as operating activities, which can affect cash flow from operations.

- Balance Sheet Impacts: ASC 842 lease amortization can have a significant impact on the balance sheet. Companies are required to recognize lease assets and liabilities, which can affect key metrics such as debt-to-equity ratios and return on assets.

- Disclosure Requirements: The new standard requires companies to disclose detailed information about their leases, including the lease term, lease payments, and discount rates. This increased transparency can help investors and analysts to make more informed decisions.

- Complexity and Costs: ASC 842 lease amortization can be complex and costly to implement. Companies may need to invest in new systems and processes to comply with the new standard, which can be time-consuming and expensive.

Steps to Implement ASC 842 Lease Amortization

- Identify Leases: Companies need to identify all leases with a term of more than 12 months, including operating leases and finance leases.

- Determine Lease Classification: Companies need to determine whether each lease is an operating lease or a finance lease, which will affect the accounting treatment.

- Calculate Lease Liability: Companies need to calculate the lease liability, which represents the present value of the lease payments.

- Calculate Right-of-Use Asset: Companies need to calculate the right-of-use asset, which represents the company's right to use the underlying asset.

- Apply Effective Interest Method: Companies need to apply the effective interest method to allocate the cost of the lease over its term.

Common Challenges and Solutions

- Complexity: The new standard can be complex, especially for companies with multiple leases. Solution: Invest in lease accounting software to streamline the process.

- Data Collection: Companies may struggle to collect the necessary data to comply with the new standard. Solution: Develop a data collection plan to ensure that all necessary information is gathered.

- Disclosure Requirements: The new standard requires companies to disclose detailed information about their leases. Solution: Develop a disclosure plan to ensure that all necessary information is disclosed.

Best Practices for ASC 842 Lease Amortization

- Develop a Lease Accounting Policy: Companies should develop a lease accounting policy to ensure consistency in accounting for leases.

- Invest in Lease Accounting Software: Companies should invest in lease accounting software to streamline the process and ensure compliance.

- Provide Training: Companies should provide training to employees on the new standard and its requirements.

- Monitor and Review: Companies should monitor and review their lease accounting processes to ensure compliance and identify areas for improvement.

Gallery of ASC 842 Lease Amortization

ASC 842 Lease Amortization Image Gallery

What is ASC 842 lease amortization?

+ASC 842 lease amortization is the process of allocating the cost of a lease over its term, as required by the new standard.

How does ASC 842 lease amortization impact financial statements?

+ASC 842 lease amortization can impact financial statements in several ways, including increased expenses, changes in cash flow, and balance sheet impacts.

What are the benefits of ASC 842 lease amortization?

+The benefits of ASC 842 lease amortization include increased transparency, improved financial reporting, and better decision-making.

How can companies implement ASC 842 lease amortization?

+Companies can implement ASC 842 lease amortization by identifying leases, determining lease classification, calculating lease liability, and applying the effective interest method.

What are the common challenges and solutions for ASC 842 lease amortization?

+Common challenges for ASC 842 lease amortization include complexity, data collection, and disclosure requirements. Solutions include investing in lease accounting software, developing a data collection plan, and providing training to employees.

In

Final Thoughts on ASC 842 Lease Amortization