Intro

Simplify lease accounting with our ASC 842 lease calculation template, featuring comprehensive lease analysis, amortization schedules, and ROI calculations for accurate financial reporting and compliance.

The Accounting Standards Codification (ASC) 842 is a new lease accounting standard that was issued by the Financial Accounting Standards Board (FASB) in 2016. The standard requires lessees to recognize lease assets and liabilities on their balance sheets for all leases with terms of more than 12 months. This change has significant implications for companies that lease assets, such as property, equipment, and vehicles. In this article, we will discuss the ASC 842 lease calculation template and provide guidance on how to implement the new standard.

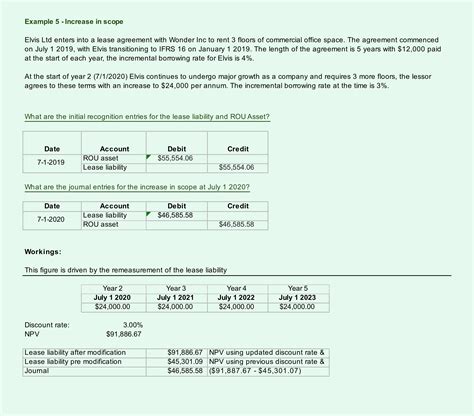

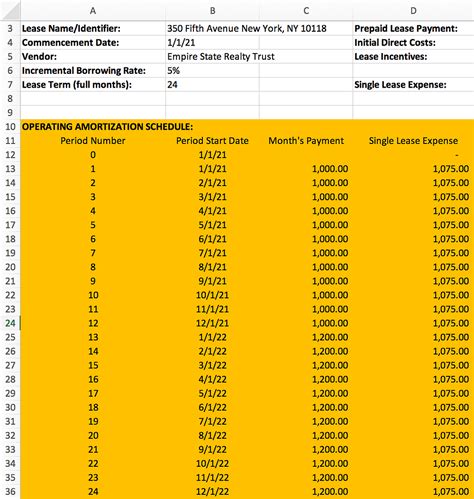

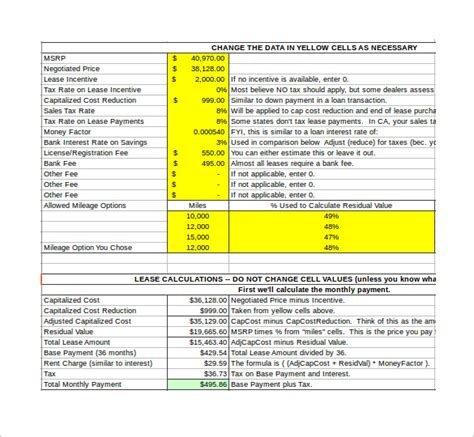

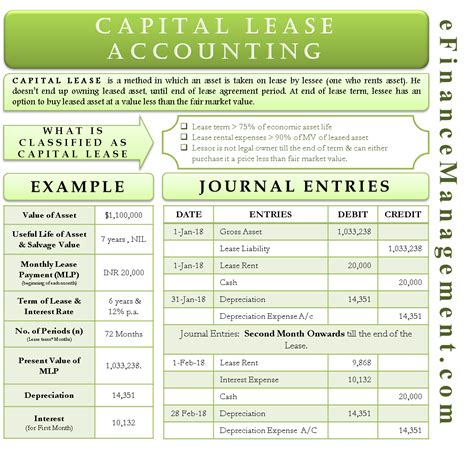

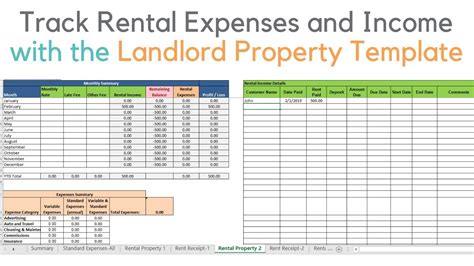

The ASC 842 lease calculation template is a tool that helps companies calculate the lease assets and liabilities that must be recognized on their balance sheets. The template requires companies to input certain information about their leases, such as the lease term, lease payments, and discount rate. The template then calculates the present value of the lease payments, which is used to determine the lease asset and liability.

To use the ASC 842 lease calculation template, companies must first gather certain information about their leases. This includes:

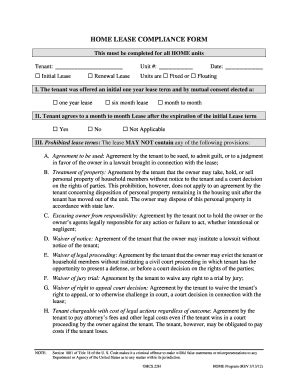

- Lease term: The length of time that the company has the right to use the leased asset.

- Lease payments: The amount of money that the company must pay to the lessor each period.

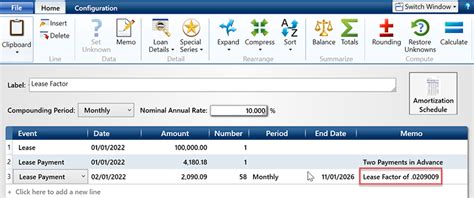

- Discount rate: The interest rate that is used to calculate the present value of the lease payments.

- Lease commencement date: The date when the company begins to use the leased asset.

- Lease expiration date: The date when the company's right to use the leased asset expires.

Understanding the ASC 842 Lease Calculation Template

The ASC 842 lease calculation template is a complex tool that requires companies to input a significant amount of information about their leases. The template is typically used by companies that have a large number of leases, such as retail companies that lease multiple stores or equipment manufacturers that lease equipment to customers.

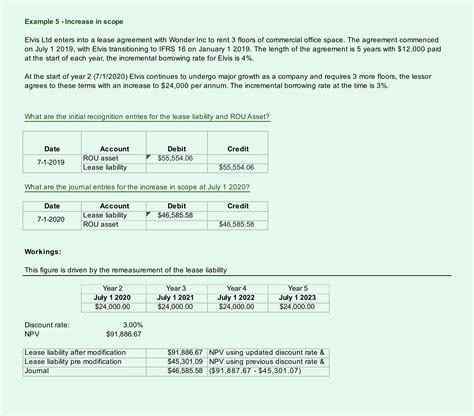

To calculate the lease asset and liability, the template uses the following formula: Lease asset = Present value of lease payments Lease liability = Present value of lease payments

The present value of the lease payments is calculated using the discount rate and the lease term. The discount rate is the interest rate that is used to calculate the present value of the lease payments. The lease term is the length of time that the company has the right to use the leased asset.

Benefits of Using the ASC 842 Lease Calculation Template

The ASC 842 lease calculation template provides several benefits to companies that use it. These benefits include: * Improved accuracy: The template helps companies to accurately calculate the lease assets and liabilities that must be recognized on their balance sheets. * Increased efficiency: The template automates the calculation process, which saves time and reduces the risk of errors. * Better decision-making: The template provides companies with a clear picture of their lease obligations, which helps them to make better decisions about their leasing activities.Implementing the ASC 842 Lease Calculation Template

Implementing the ASC 842 lease calculation template requires companies to follow a series of steps. These steps include:

- Gathering information about leases: Companies must gather information about their leases, including the lease term, lease payments, and discount rate.

- Inputting data into the template: Companies must input the data into the template, which calculates the present value of the lease payments.

- Reviewing and verifying the results: Companies must review and verify the results to ensure that they are accurate and complete.

- Updating accounting records: Companies must update their accounting records to reflect the new lease assets and liabilities.

Common Challenges in Implementing the ASC 842 Lease Calculation Template

Companies that implement the ASC 842 lease calculation template may face several challenges. These challenges include: * Gathering accurate data: Companies may struggle to gather accurate data about their leases, which can lead to errors in the calculation process. * Understanding the template: Companies may struggle to understand the template and how to use it, which can lead to errors and delays. * Integrating with existing systems: Companies may struggle to integrate the template with their existing accounting systems, which can lead to errors and delays.Best Practices for Using the ASC 842 Lease Calculation Template

To get the most out of the ASC 842 lease calculation template, companies should follow best practices. These best practices include:

- Gathering accurate data: Companies should gather accurate data about their leases to ensure that the calculations are accurate and complete.

- Understanding the template: Companies should take the time to understand the template and how to use it to avoid errors and delays.

- Integrating with existing systems: Companies should integrate the template with their existing accounting systems to ensure seamless processing and reporting.

- Reviewing and verifying results: Companies should review and verify the results to ensure that they are accurate and complete.

Common Mistakes to Avoid When Using the ASC 842 Lease Calculation Template

Companies that use the ASC 842 lease calculation template may make several mistakes. These mistakes include: * Inputting incorrect data: Companies may input incorrect data into the template, which can lead to errors in the calculation process. * Failing to review and verify results: Companies may fail to review and verify the results, which can lead to errors and delays. * Not integrating with existing systems: Companies may not integrate the template with their existing accounting systems, which can lead to errors and delays.ASC 842 Lease Calculation Template Image Gallery

What is the ASC 842 lease calculation template?

+The ASC 842 lease calculation template is a tool that helps companies calculate the lease assets and liabilities that must be recognized on their balance sheets.

How do I implement the ASC 842 lease calculation template?

+To implement the ASC 842 lease calculation template, companies must gather information about their leases, input the data into the template, review and verify the results, and update their accounting records.

What are the benefits of using the ASC 842 lease calculation template?

+The ASC 842 lease calculation template provides several benefits, including improved accuracy, increased efficiency, and better decision-making.

In conclusion, the ASC 842 lease calculation template is a powerful tool that helps companies calculate the lease assets and liabilities that must be recognized on their balance sheets. By following best practices and avoiding common mistakes, companies can ensure that they are using the template effectively and accurately. If you have any questions or comments about the ASC 842 lease calculation template, please feel free to share them below. We would be happy to hear your thoughts and provide further guidance on this topic.