Intro

Master ASC 606 memos with 5 expert tips, ensuring revenue recognition accuracy and compliance, while navigating complex contract modifications and performance obligations.

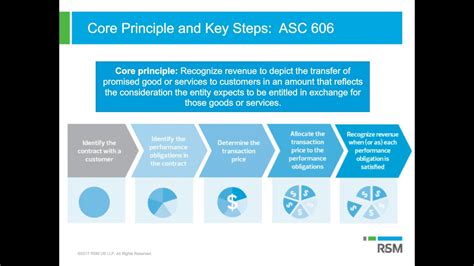

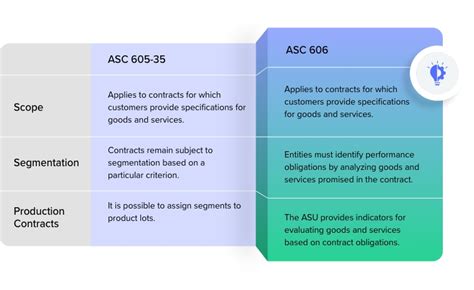

The importance of understanding and implementing ASC 606, also known as Revenue from Contracts with Customers, cannot be overstated. This standard, issued by the Financial Accounting Standards Board (FASB), represents a significant shift in how companies recognize revenue, affecting financial reporting, compliance, and ultimately, a company's bottom line. As businesses navigate the complexities of ASC 606, having a clear and comprehensive approach to its implementation is crucial. This includes creating effective memoranda (memos) that communicate key aspects of the standard to stakeholders.

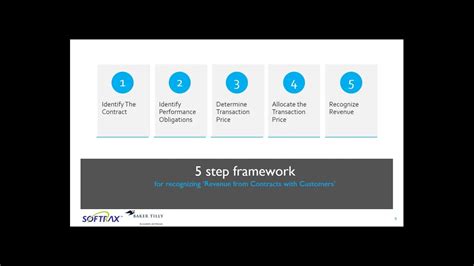

Implementing ASC 606 requires a thorough analysis of contracts, identification of performance obligations, determination of transaction prices, and allocation of that price to each performance obligation. It also necessitates the establishment of a robust system to track and report revenue accurately under the new standard. Given the complexity and the impact on financial statements, companies must ensure that all relevant personnel understand the principles of ASC 606 and how it applies to their specific roles and responsibilities.

The transition to ASC 606 can be daunting, especially for companies with diverse revenue streams or complex contract arrangements. It involves not only a change in accounting policies but also potential modifications to business processes, IT systems, and internal controls. Effective communication and documentation are vital in this process, making the role of ASC 606 memos indispensable. These memos serve as a critical tool for disseminating information, providing guidance, and ensuring consistency in the application of the standard across the organization.

Introduction to ASC 606 Memos

ASC 606 memos are internal documents designed to inform and guide employees on the implementation and ongoing application of the ASC 606 standard. They cover a range of topics from the fundamental principles of the standard to specific application issues and internal policies for compliance. These memos are essential for ensuring that all aspects of revenue recognition are addressed consistently and accurately, reflecting the company's commitment to financial integrity and regulatory compliance.

Key Components of ASC 606 Memos

Effective ASC 606 memos should include several key components:

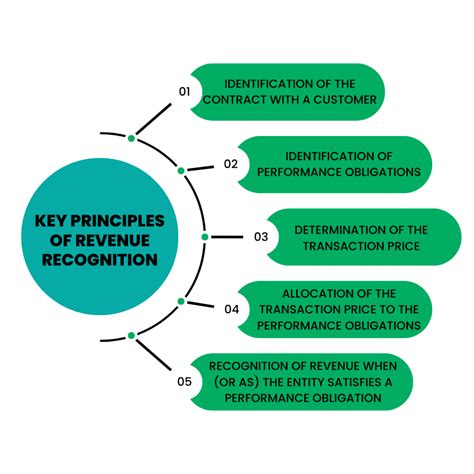

- Summary of ASC 606: A brief overview of the standard, its objectives, and the core principles of revenue recognition.

- Scope and Applicability: Guidance on which contracts and transactions are subject to ASC 606, including any exemptions or exceptions.

- Identification of Performance Obligations: Instructions on how to identify distinct performance obligations within a contract, which is crucial for determining the appropriate revenue recognition approach.

- Determining the Transaction Price: Explanation of how to determine the transaction price, including the consideration of variable consideration, time value of money, and non-cash considerations.

- Allocation of the Transaction Price: Guidance on allocating the transaction price to each performance obligation, including the use of the relative stand-alone selling price method.

- Revenue Recognition: Detailed instructions on when to recognize revenue, based on the satisfaction of performance obligations (either over time or at a point in time).

Best Practices for Creating ASC 606 Memos

To ensure that ASC 606 memos are effective, companies should follow several best practices:

- Clarity and Simplicity: Use clear and simple language to explain complex concepts, avoiding technical jargon whenever possible.

- Relevance: Tailor the content of the memo to the specific needs and roles of the intended audience.

- Examples and Case Studies: Include practical examples or case studies to illustrate the application of ASC 606 principles, helping to make the guidance more accessible and understandable.

- Regular Updates: Regularly review and update ASC 606 memos to reflect changes in the standard, company policies, or common issues encountered during implementation.

- Accessibility: Ensure that memos are easily accessible to all relevant personnel, considering the use of internal portals or document management systems.

Benefits of Implementing ASC 606 Memos

The implementation of ASC 606 memos offers several benefits to organizations:

- Improved Compliance: Enhances compliance with the ASC 606 standard, reducing the risk of non-compliance and associated penalties.

- Consistency: Promotes consistency in the application of revenue recognition principles across the organization.

- Reduced Errors: Helps minimize errors in financial reporting by providing clear guidance on revenue recognition.

- Enhanced Transparency: Contributes to more transparent financial reporting, as revenue is recognized in accordance with the standard.

- Better Decision Making: Supports better decision-making by ensuring that financial information accurately reflects the company's financial position and performance.

Challenges in Creating Effective ASC 606 Memos

Despite the importance of ASC 606 memos, companies may face several challenges in creating effective documents:

- Complexity of the Standard: The inherent complexity of ASC 606 can make it difficult to explain its principles and application in a clear and concise manner.

- Limited Resources: Smaller companies or those with limited accounting and legal resources may struggle to dedicate the necessary time and expertise to crafting comprehensive memos.

- Keeping Up-to-Date: The evolving nature of accounting standards and regulatory guidance means that memos must be regularly updated, which can be resource-intensive.

- Ensuring Accessibility and Understanding: Companies must ensure that memos are not only accessible but also understood by all relevant personnel, which can be challenging given the diverse backgrounds and roles within an organization.

Future of ASC 606 and Revenue Recognition

As the business environment continues to evolve, with changes in technology, consumer behavior, and regulatory landscapes, the importance of robust revenue recognition standards like ASC 606 will only grow. The future of revenue recognition will likely be characterized by increased complexity, with more emphasis on digital transactions, subscription-based models, and international trade. Therefore, companies must remain vigilant, continually assessing and refining their revenue recognition practices to ensure compliance and accuracy.

Gallery of ASC 606 Implementation

ASC 606 Implementation Image Gallery

What is ASC 606 and its main objective?

+ASC 606, or Revenue from Contracts with Customers, is a standard issued by the Financial Accounting Standards Board (FASB) that aims to improve the reporting of revenue and to provide a more robust framework for revenue recognition. Its main objective is to establish a single, comprehensive model for revenue recognition that can be applied consistently across different industries and transactions.

How does ASC 606 affect financial reporting and compliance?

+ASC 606 significantly affects financial reporting by requiring companies to recognize revenue based on the satisfaction of performance obligations, which can lead to changes in the timing and amount of revenue recognized. It also impacts compliance by necessitating the disclosure of more detailed information about revenue recognition policies, contract balances, and transaction prices.

What are the key challenges in implementing ASC 606 memos?

+The key challenges include the complexity of the standard, limited resources, keeping the memos up-to-date with evolving standards and regulatory guidance, and ensuring that the memos are accessible and understood by all relevant personnel.

How can companies ensure the effectiveness of ASC 606 memos?

+Companies can ensure the effectiveness of ASC 606 memos by using clear and simple language, tailoring the content to the specific needs of the audience, including practical examples, regularly updating the memos, and making them easily accessible to all relevant personnel.

What are the benefits of implementing ASC 606 memos?

+The benefits include improved compliance with the ASC 606 standard, consistency in the application of revenue recognition principles, reduced errors in financial reporting, enhanced transparency, and better decision-making based on accurate financial information.

As we move forward in the era of ASC 606, the role of effective communication and documentation, such as through ASC 606 memos, will continue to be vital. These memos not only facilitate compliance with the standard but also contribute to a culture of transparency and financial integrity within organizations. By understanding the importance of ASC 606 memos and implementing them effectively, companies can navigate the complexities of revenue recognition with confidence, ultimately enhancing their financial reporting and decision-making processes. We invite readers to share their experiences and insights on implementing ASC 606 and the challenges they have faced, contributing to a broader discussion on best practices in revenue recognition.