Intro

Discover essential Arizona will tips, including estate planning, probate, inheritance, and asset protection, to ensure a smooth transfer of assets and minimize legal issues for beneficiaries and heirs.

Creating a will is an essential part of estate planning, ensuring that your assets are distributed according to your wishes after you pass away. In Arizona, as in other states, there are specific laws and considerations to keep in mind when drafting a will. Understanding these can help you navigate the process more effectively.

The importance of having a will cannot be overstated. It not only ensures that your property and assets are distributed as you intend, but it also allows you to appoint a guardian for your minor children, name an executor to manage your estate, and make specific gifts to individuals or charities. Without a will, the distribution of your assets will be determined by Arizona's intestacy laws, which may not align with your personal preferences.

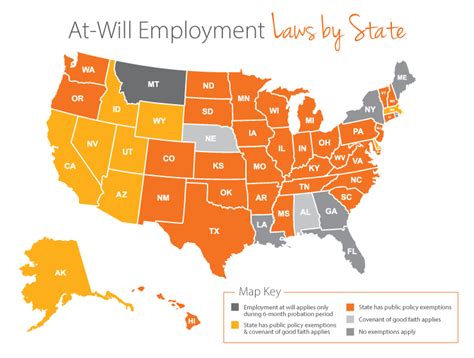

For individuals living in Arizona, being aware of the state's specific requirements and regulations regarding wills is crucial. This includes understanding the legal formalities for signing a will, the role of witnesses, and what constitutes a valid will under Arizona law. Additionally, considering the tax implications of your estate and how to minimize tax liabilities can be an important aspect of will planning.

Understanding Arizona Will Laws

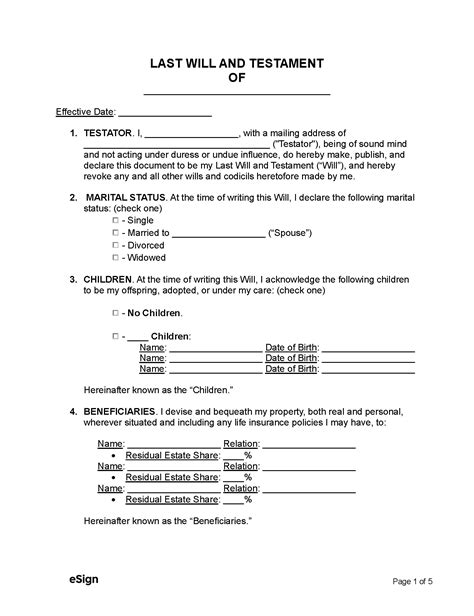

Arizona will laws are designed to protect the rights of the testator (the person making the will) and their beneficiaries. A key aspect of Arizona law is the requirement that a will must be in writing and signed by the testator or by someone else in the testator's presence and at their direction. Furthermore, the will must be witnessed by at least two people who are not beneficiaries under the will. These witnesses must sign the will in the presence of the testator and each other.

Benefits of Having a Will in Arizona

There are numerous benefits to having a will in Arizona. One of the most significant advantages is the ability to control how your assets are distributed. Without a will, the state's intestacy laws dictate how your estate is divided, which may result in your assets going to relatives you are not close to or not providing for loved ones as you would wish. A will also allows you to name a personal representative (executor) who will manage your estate according to your instructions, ensuring that your wishes are carried out.

Additionally, having a will can reduce conflicts among family members and beneficiaries. By clearly stating your intentions, you can avoid disputes over who should inherit certain assets. For parents of minor children, a will is especially important as it allows you to name a guardian for your children in the event of your death.

Steps to Create a Valid Will in Arizona

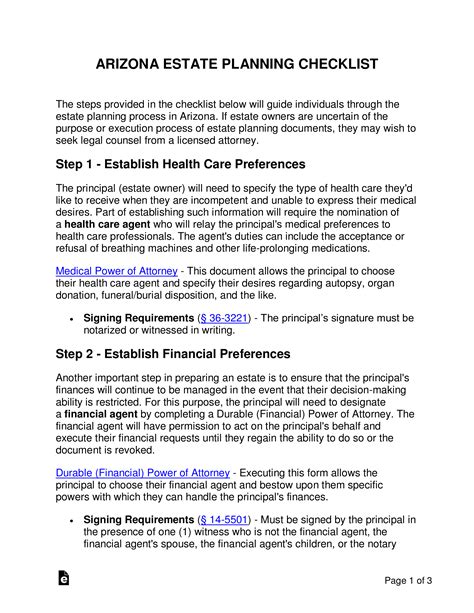

Creating a valid will in Arizona involves several steps:

- Determine Your Assets: Make a list of all your assets, including real estate, vehicles, bank accounts, investments, and personal property.

- Decide on Beneficiaries: Choose who you want to inherit your assets. Consider family members, friends, and any charities you wish to support.

- Choose a Personal Representative: Select someone you trust to serve as the executor of your estate. This person will be responsible for carrying out the instructions in your will.

- Name a Guardian: If you have minor children, decide who you want to care for them in the event of your death.

- Consider a Trust: Depending on your situation, you may also want to consider creating a trust to manage certain assets or to minimize tax liabilities.

- Draft Your Will: You can use a will template or consult with an attorney to draft your will. Ensure it meets Arizona's legal requirements.

- Sign Your Will: Sign your will in the presence of at least two witnesses, who must also sign the document.

Common Mistakes to Avoid in Arizona Wills

Several common mistakes can invalidate a will or lead to unintended consequences. These include:

- Not Having Your Will Witnessed Correctly: Failing to have your will signed by the required number of witnesses can render it invalid.

- Not Updating Your Will: Failing to update your will after significant life changes, such as marriage, divorce, or the birth of children, can mean your will does not reflect your current wishes.

- Using Incorrect Language: Using ambiguous language can lead to confusion and disputes among beneficiaries.

- Not Considering Tax Implications: Failing to consider the tax implications of your estate can result in a significant portion of your assets going towards taxes rather than your beneficiaries.

Seeking Professional Advice for Your Arizona Will

While it is possible to create a will on your own, seeking professional advice from an attorney who specializes in estate planning can be highly beneficial. An attorney can help ensure that your will is valid and enforceable under Arizona law, and they can provide guidance on more complex issues such as tax planning and the use of trusts.

Gallery of Arizona Will Tips

Arizona Will Tips Image Gallery

What are the basic requirements for a will to be valid in Arizona?

+A will must be in writing, signed by the testator or by someone else in the testator's presence and at their direction, and witnessed by at least two people who are not beneficiaries under the will.

Can I make changes to my will after it has been signed?

+Yes, you can make changes to your will through a codicil, which is a separate document that amends your original will. However, it's often recommended to create a new will rather than amending an existing one to avoid confusion.

Do I need an attorney to create a will in Arizona?

+While it's possible to create a will on your own, consulting with an attorney who specializes in estate planning can ensure that your will is valid and meets all the legal requirements in Arizona.

In conclusion, creating a will is a vital step in ensuring that your wishes are respected and your loved ones are protected after you're gone. By understanding Arizona's will laws, avoiding common mistakes, and seeking professional advice when needed, you can create a will that accurately reflects your intentions and provides peace of mind for you and your family. We invite you to share your thoughts on the importance of having a will and any experiences you may have with estate planning. Your insights can help others understand the value of planning for the future.