Intro

Boost financial clarity with 5 amortization tips, simplifying loan repayment, mortgage calculations, and interest schedules, using amortization tables and calculators for efficient debt management.

Amortization is a fundamental concept in finance that can help individuals and businesses manage their loans and debts more effectively. It refers to the process of gradually paying off a debt through regular payments, which cover both the principal amount and the interest accrued. Understanding amortization is crucial for making informed decisions about loans, mortgages, and other financial obligations. In this article, we will delve into the world of amortization, exploring its importance, benefits, and providing valuable tips for managing amortization schedules.

Amortization plays a vital role in personal finance, as it allows individuals to budget and plan for their financial obligations. By spreading out the cost of a loan over a fixed period, amortization helps to reduce the financial burden of large purchases, such as homes or cars. Moreover, amortization can help businesses manage their cash flow, ensuring that they have sufficient funds to meet their financial obligations. Whether you are an individual or a business owner, understanding amortization is essential for maintaining a healthy financial profile.

The importance of amortization cannot be overstated, as it has a significant impact on an individual's or business's financial well-being. Amortization schedules can be complex, with varying interest rates, payment terms, and fees. However, by grasping the basics of amortization, individuals and businesses can make informed decisions about their financial obligations, avoid debt traps, and optimize their financial performance. In the following sections, we will provide practical tips and insights on how to manage amortization schedules effectively, ensuring that you get the most out of your loans and debts.

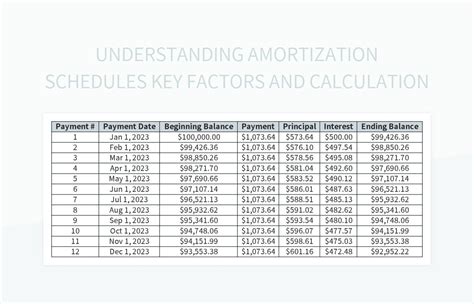

Understanding Amortization Schedules

Breaking Down Amortization Schedules

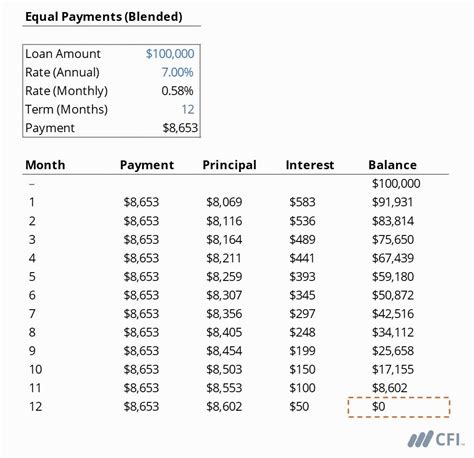

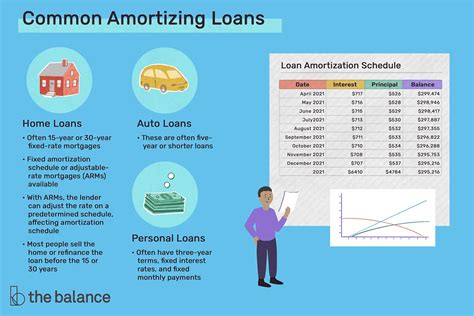

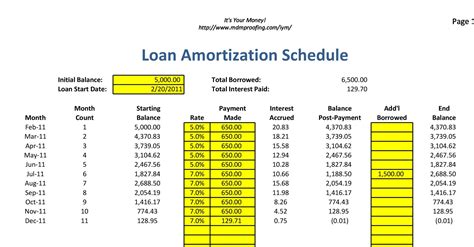

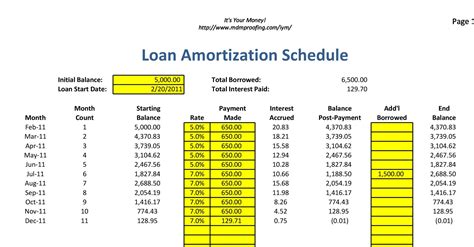

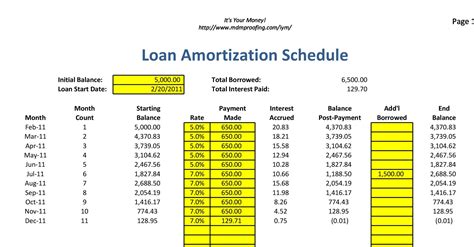

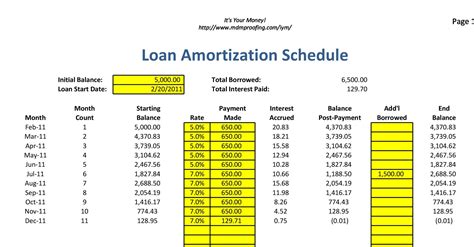

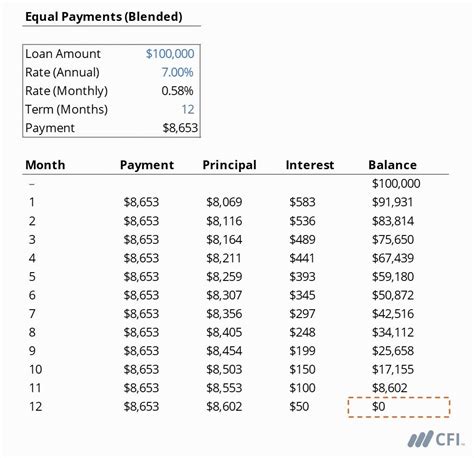

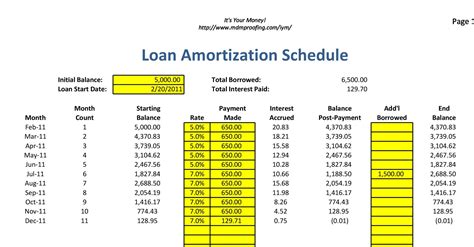

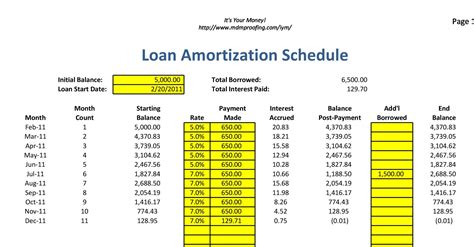

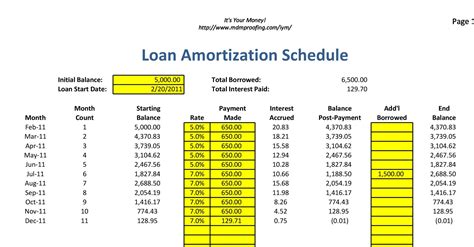

Amortization schedules can be broken down into several key components, including: * Principal amount: The initial amount borrowed * Interest rate: The rate at which interest is charged on the principal amount * Loan term: The duration of the loan * Payment frequency: The frequency of payments, such as monthly or quarterly * Fees: Additional charges associated with the loan, such as origination fees or late payment fees By understanding these components, individuals and businesses can create a tailored approach to managing their amortization schedules, ensuring that they meet their financial obligations while minimizing costs.5 Amortization Tips

Implementing Amortization Tips

Implementing these amortization tips requires a disciplined approach, with individuals and businesses committing to regular reviews and adjustments. By following these tips, individuals and businesses can: * Reduce interest costs * Accelerate the amortization process * Simplify their finances * Improve their financial flexibility * Achieve their long-term financial goalsAmortization Strategies for Businesses

Amortization Best Practices for Businesses

Businesses should follow best practices when managing amortization schedules, including: * Regularly reviewing and adjusting amortization schedules * Monitoring interest rates and loan terms * Making extra payments to reduce principal amounts * Using amortization calculators to analyze schedules * Prioritizing cash flow managementAmortization Tools and Resources

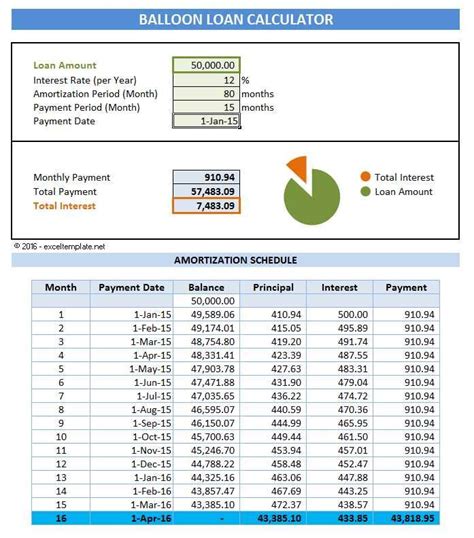

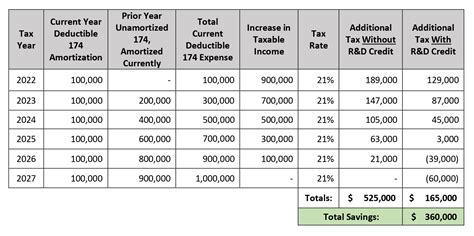

Using Amortization Tools and Resources

Using these tools and resources requires a basic understanding of amortization concepts, including principal amounts, interest rates, and loan terms. By leveraging these tools, individuals and businesses can: * Create detailed amortization schedules * Analyze payment terms and interest rates * Identify areas for optimization * Make informed decisions about their financial obligationsGallery of Amortization Examples

Amortization Image Gallery

Frequently Asked Questions

What is amortization?

+Amortization is the process of gradually paying off a debt through regular payments, which cover both the principal amount and the interest accrued.

How does amortization work?

+Amortization works by spreading out the cost of a loan over a fixed period, with each payment covering both the principal amount and the interest accrued.

What are the benefits of amortization?

+The benefits of amortization include reducing the financial burden of large purchases, simplifying finances, and optimizing loan terms.

How can I manage my amortization schedule?

+You can manage your amortization schedule by regularly reviewing and adjusting your payment terms, making extra payments, and using amortization calculators to analyze your schedule.

What are some common amortization mistakes?

+Common amortization mistakes include not regularly reviewing and adjusting payment terms, not making extra payments, and not using amortization calculators to analyze schedules.

In conclusion, managing amortization schedules requires a strategic approach, taking into account the unique circumstances of each individual or business. By following the 5 amortization tips outlined in this article, individuals and businesses can optimize their amortization schedules, reduce interest costs, and achieve their long-term financial goals. Whether you are a seasoned financial expert or just starting to navigate the world of amortization, this article has provided valuable insights and practical advice to help you manage your amortization schedules effectively. We encourage you to share your thoughts and experiences with amortization in the comments section below, and to explore our other articles and resources for more information on personal finance and business management.