Intro

Learn 5 tips for crafting a effective 623 dispute letter to remove errors from credit reports, improve credit scores, and master credit dispute techniques with proven methods and strategies.

The process of disputing errors on your credit report can be daunting, but with the right approach, you can effectively resolve issues and improve your credit score. One crucial step in this process is writing a dispute letter to the credit reporting agency. In this article, we will delve into the importance of dispute letters, provide tips on how to write an effective one, and explore the overall process of disputing credit report errors.

Disputing errors on your credit report is essential for maintaining a healthy credit score. Errors can lead to denied credit applications, higher interest rates, and even job losses. According to the Federal Trade Commission (FTC), one in five consumers has an error on at least one of their credit reports. This statistic underscores the need for consumers to be proactive in monitoring and correcting their credit information.

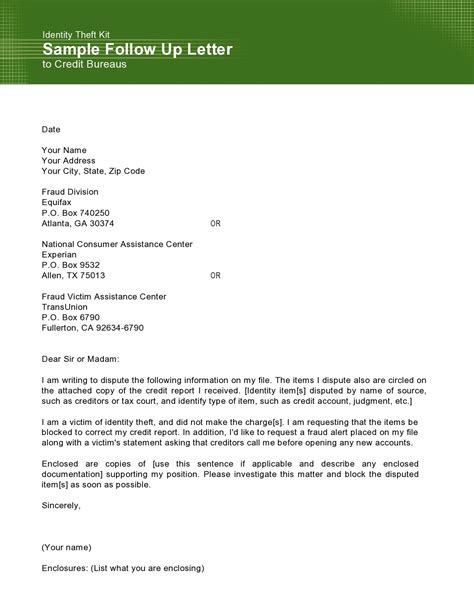

The credit reporting process involves three major credit reporting agencies: Equifax, Experian, and TransUnion. These agencies collect and maintain information about your credit history, including payments, credit inquiries, and public records. When you identify an error on your credit report, you should immediately notify the credit reporting agency in writing. This is where a dispute letter comes into play.

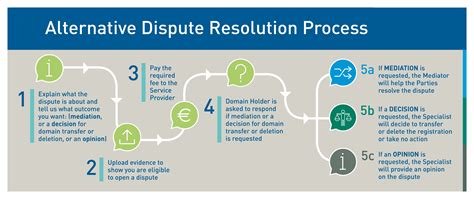

Understanding the Dispute Process

The dispute process begins with obtaining a copy of your credit report from each of the three major credit reporting agencies. You can request a free report once a year from AnnualCreditReport.com. Review each report carefully, looking for any inaccuracies or discrepancies. Common errors include incorrect personal information, accounts that do not belong to you, and outdated information.

Preparing to Write a Dispute Letter

Before writing a dispute letter, gather all relevant documentation that supports your claim. This may include bank statements, payment records, and identification documents. Clearly identify the error on your credit report and specify the correction you are requesting. It's also essential to keep a record of all correspondence with the credit reporting agency, including dates, times, and the content of discussions.

5 Tips for Writing an Effective Dispute Letter

- Be Clear and Concise: Clearly state the purpose of your letter and the specific error you are disputing. Avoid using jargon or technical terms that might confuse the reader.

- Include Relevant Documentation: Attach copies of any documents that support your dispute. Ensure these documents are legible and relevant to the error you are disputing.

- Specify the Correction: Clearly state the correction you are requesting. This could be the removal of an incorrect account or the updating of outdated information.

- Keep a Professional Tone: Maintain a polite and professional tone throughout the letter. Avoid being confrontational or aggressive, as this could hinder the resolution process.

- Proofread: Before sending the letter, proofread it carefully for spelling and grammar errors. A well-written letter will be taken more seriously and is less likely to be misunderstood.

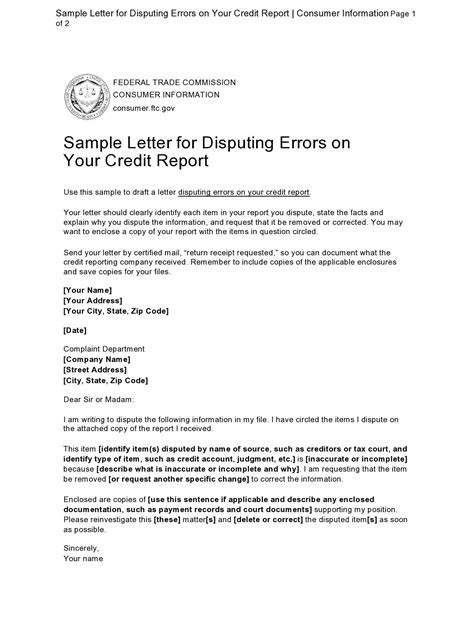

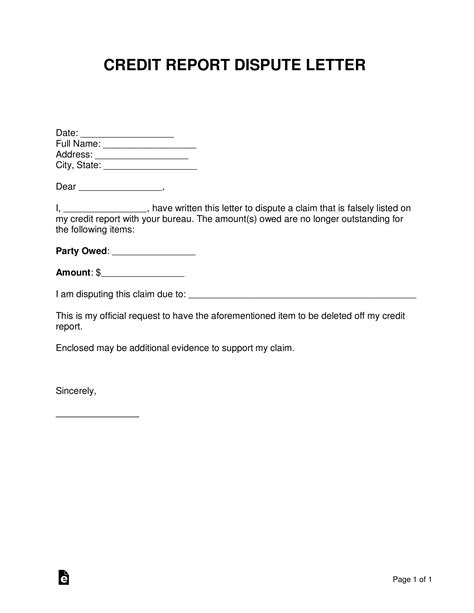

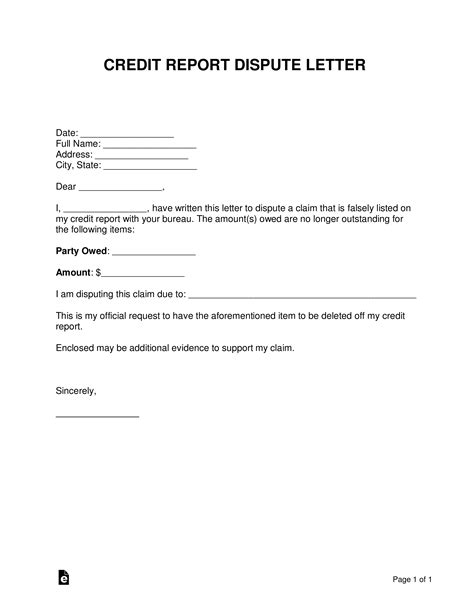

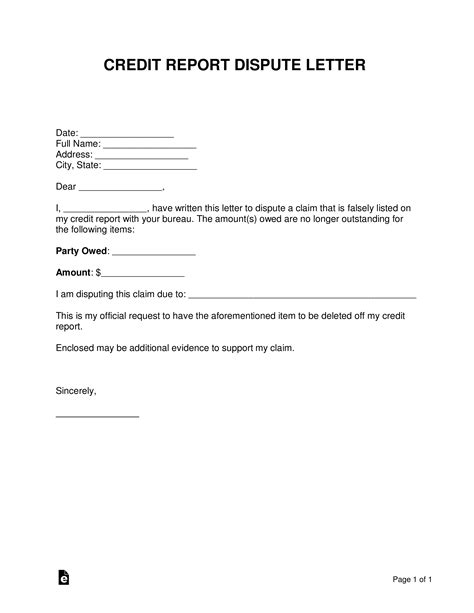

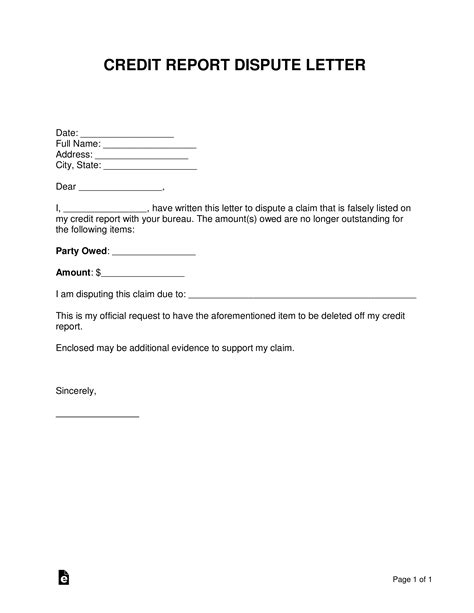

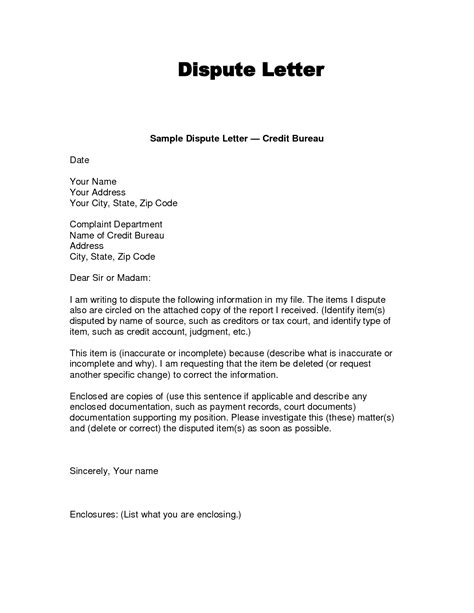

Example of a Dispute Letter

When writing your dispute letter, consider the following example as a guide:

- Start by addressing the credit reporting agency.

- Clearly state the error you are disputing and the correction you are requesting.

- Attach relevant documentation.

- Include your contact information for follow-up.

Follow-Up and Resolution

After sending your dispute letter, the credit reporting agency has 30 to 45 days to investigate and respond. They will contact the creditor to verify the information. If the creditor agrees that the information is incorrect, it will be updated on your credit report. If the investigation finds that the information is accurate, the credit reporting agency will notify you with an explanation.

Gallery of Dispute Letter Templates

Dispute Letter Templates Gallery

Frequently Asked Questions

What is the purpose of a dispute letter?

+The purpose of a dispute letter is to notify the credit reporting agency of an error on your credit report and request a correction.

How long does it take for the credit reporting agency to respond to a dispute letter?

+The credit reporting agency has 30 to 45 days to investigate and respond to your dispute letter.

What should I do if the credit reporting agency does not correct the error after I send a dispute letter?

+If the error is not corrected, you may need to escalate the dispute by contacting the creditor directly or seeking assistance from a consumer protection agency.

In conclusion, writing an effective dispute letter is a critical step in correcting errors on your credit report. By following the tips outlined in this article and understanding the dispute process, you can ensure that your credit report accurately reflects your credit history. Remember to stay vigilant, monitor your credit report regularly, and do not hesitate to dispute any errors you find. Your credit score is a vital component of your financial health, and taking proactive steps to protect it can have long-term benefits. We invite you to share your experiences with dispute letters and credit report errors in the comments below, and please consider sharing this article with others who may benefit from this information.