Intro

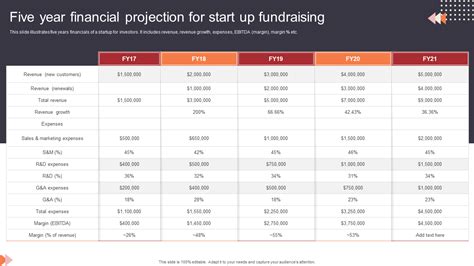

Create accurate 5 Year Financial Projections with revenue forecasts, expense planning, and cash flow analysis to drive business growth and informed investment decisions.

Creating a 5-year financial projection is a crucial step for any business, whether it's a startup or an established company looking to expand or restructure. This process involves forecasting the company's financial performance over a five-year period, considering various factors such as revenue growth, expenses, investments, and funding requirements. The importance of accurate financial projections cannot be overstated, as they serve as a roadmap for the company's future, helping to secure investments, inform strategic decisions, and measure performance against goals.

Understanding the significance of 5-year financial projections is essential for entrepreneurs and business leaders. These projections are not just about predicting numbers; they are about crafting a comprehensive plan that outlines how the company intends to achieve its objectives. This includes detailing the strategies for revenue generation, cost management, and capital allocation. By doing so, businesses can better navigate challenges, capitalize on opportunities, and ensure sustainable growth.

The process of developing 5-year financial projections requires a deep understanding of the business, its market, and the broader economic landscape. It involves analyzing historical financial data, industry trends, market research, and competitive analysis to make informed predictions about future financial performance. This analysis helps in identifying potential risks and opportunities, which are critical components of any financial projection. By acknowledging and planning for these factors, businesses can develop more realistic and achievable financial goals.

Benefits of 5-Year Financial Projections

The benefits of creating 5-year financial projections are multifaceted. Firstly, they provide a clear direction for the company, aligning all stakeholders towards common goals. Secondly, they help in securing funding from investors, who often require detailed financial projections to assess the viability and potential return on investment. Thirdly, these projections enable businesses to make informed decisions regarding investments, expansions, and cost-cutting measures. By having a long-term financial plan, companies can better manage their cash flow, reduce financial risks, and improve their overall financial health.

Key Components of 5-Year Financial Projections

When developing 5-year financial projections, several key components must be considered:

- Income Statement: This outlines the company's revenues and expenses over the projection period, providing insights into profitability.

- Balance Sheet: It gives a snapshot of the company's financial position at a given point in time, including assets, liabilities, and equity.

- Cash Flow Statement: This shows the inflows and outflows of cash, which is crucial for understanding the company's liquidity and ability to meet its financial obligations.

- Break-Even Analysis: This determines the point at which the company's total revenue equals its total fixed and variable costs, indicating the threshold for profitability.

Steps to Create 5-Year Financial Projections

Creating accurate 5-year financial projections involves several steps:

- Review Historical Financial Data: Analyze past financial performance to identify trends and patterns.

- Conduct Market Research: Understand the market size, growth potential, and competitive landscape.

- Set Financial Goals: Based on the analysis, set realistic and achievable financial objectives.

- Forecast Revenue: Estimate future revenue based on market research and historical data.

- Estimate Expenses: Predict future expenses, considering inflation, growth, and efficiency improvements.

- Determine Funding Requirements: Calculate if additional funding is needed to achieve the financial goals.

- Regularly Review and Update: Financial projections should be dynamic, reflecting changes in the market, industry, and company performance.

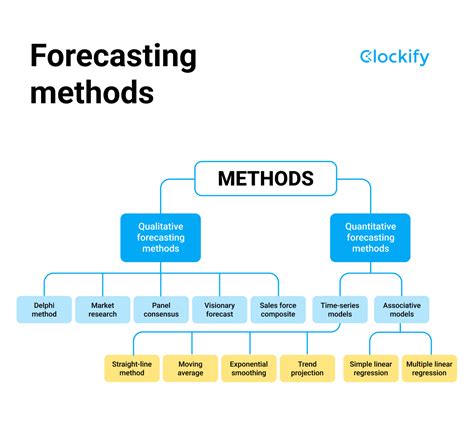

Tools and Techniques for Financial Projections

Various tools and techniques can aid in creating 5-year financial projections:

- Spreadsheets: Software like Excel is commonly used for financial modeling due to its flexibility and calculation capabilities.

- Financial Planning Software: Dedicated software can streamline the process, offering templates and automated calculations.

- Consultants and Advisors: External experts can provide valuable insights and help in developing realistic projections.

Challenges in Creating 5-Year Financial Projections

Despite the importance of 5-year financial projections, several challenges exist:

- Uncertainty: Predicting future events, especially in volatile markets, can be highly uncertain.

- Complexity: The process requires a deep understanding of financial principles, market trends, and business operations.

- Data Quality: The accuracy of projections depends on the quality of historical data and market research.

Best Practices for Effective Financial Projections

To overcome these challenges and create effective 5-year financial projections, consider the following best practices:

- Regular Updates: Projections should be regularly reviewed and updated to reflect changes in the business environment.

- Sensitivity Analysis: This involves testing how changes in assumptions affect the projections, helping to identify potential risks and opportunities.

- Scenario Planning: Developing projections based on different scenarios (e.g., best-case, worst-case) can help prepare for various outcomes.

Conclusion and Future Outlook

In conclusion, 5-year financial projections are a vital tool for businesses, offering a roadmap for growth, profitability, and sustainability. By understanding the benefits, components, and challenges associated with these projections, companies can better navigate the complexities of financial planning. As the business landscape continues to evolve, the importance of accurate and dynamic financial projections will only increase, making it essential for companies to adopt best practices and leverage available tools and techniques.

Financial Projections Image Gallery

What is the purpose of 5-year financial projections?

+The purpose of 5-year financial projections is to provide a roadmap for the company's future, helping to secure investments, inform strategic decisions, and measure performance against goals.

How often should financial projections be updated?

+Financial projections should be regularly reviewed and updated to reflect changes in the business environment, ideally on a quarterly or annual basis.

What are the key components of 5-year financial projections?

+The key components include the income statement, balance sheet, cash flow statement, and break-even analysis, which together provide a comprehensive view of the company's financial health and future prospects.

We hope this comprehensive guide to 5-year financial projections has been informative and helpful. Whether you're a seasoned entrepreneur or just starting out, understanding the importance and process of creating these projections can significantly impact your business's success. Feel free to share your thoughts, questions, or experiences with financial projections in the comments below. If you found this article valuable, consider sharing it with others who might benefit from this information. Together, let's navigate the complexities of financial planning and pave the way for sustainable business growth.