Intro

Discover the 5 ways W9 form simplifies tax compliance, independent contractor management, and income reporting, streamlining 1099 filing, audit preparation, and financial record-keeping.

The W9 form is a crucial document used by the Internal Revenue Service (IRS) to verify the identity and tax status of independent contractors, freelancers, and other self-employed individuals. It is essential to understand the significance of the W9 form and how it affects your business or career as a self-employed individual. In this article, we will delve into the world of W9 forms, exploring their importance, benefits, and the steps involved in completing and submitting them.

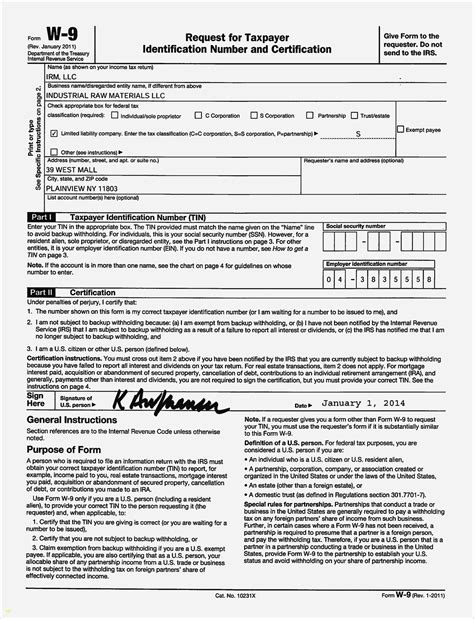

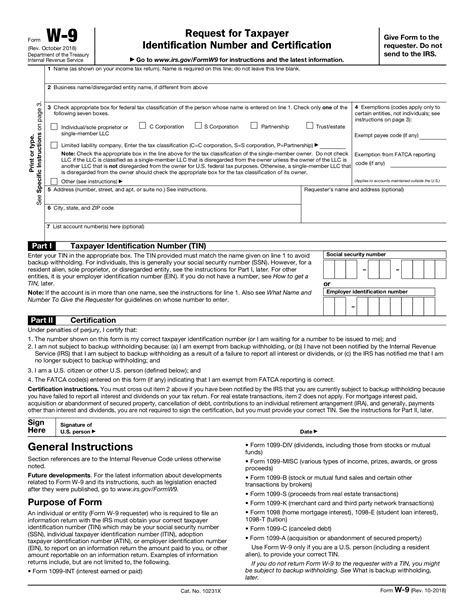

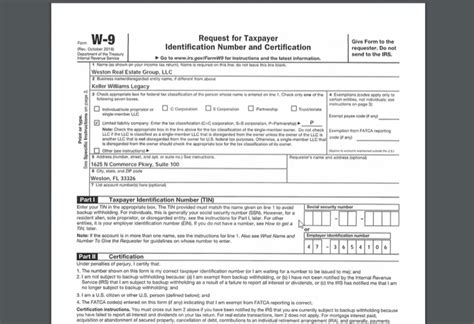

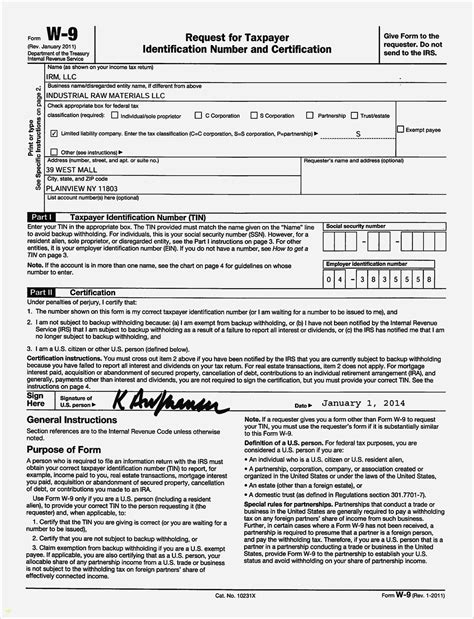

The W9 form is a one-page document that provides the IRS with the necessary information to process tax payments and verify the identity of independent contractors. It is typically requested by clients or employers who hire freelancers or independent contractors to perform specific services. The form requires the contractor to provide their name, address, tax identification number, and tax classification. This information is used to generate a 1099-MISC form, which reports the contractor's income to the IRS.

The importance of the W9 form cannot be overstated. It helps to prevent tax evasion and ensures that independent contractors are accurately reporting their income. Moreover, it provides a clear understanding of the contractor's tax obligations and helps to avoid any potential penalties or fines. As a self-employed individual, it is crucial to understand the benefits of completing a W9 form and how it can impact your business or career.

Understanding the W9 Form

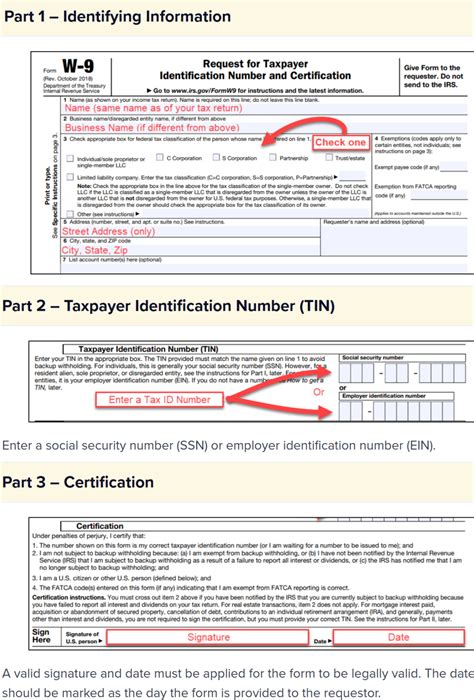

To begin with, it is essential to understand the different components of the W9 form. The form is divided into four main sections: Part I, Part II, Part III, and Part IV. Part I requires the contractor to provide their name, business name, and tax identification number. Part II asks for the contractor's tax classification, such as individual, corporation, or partnership. Part III requires the contractor to certify their tax status and provide any additional information required by the IRS. Part IV is reserved for the IRS and is not completed by the contractor.

Benefits of the W9 Form

The W9 form offers several benefits to independent contractors and clients alike. For contractors, it provides a clear understanding of their tax obligations and helps to avoid any potential penalties or fines. It also ensures that contractors are accurately reporting their income and paying the correct amount of taxes. For clients, the W9 form helps to verify the identity and tax status of contractors, reducing the risk of tax evasion and ensuring compliance with IRS regulations.Completing the W9 Form

Completing the W9 form is a relatively straightforward process. The contractor must provide their name, address, and tax identification number, as well as their tax classification. The form also requires the contractor to certify their tax status and provide any additional information required by the IRS. It is essential to ensure that all information provided is accurate and up-to-date, as any errors or discrepancies can lead to delays or penalties.

Steps Involved in Submitting the W9 Form

The steps involved in submitting the W9 form are relatively simple. The contractor must complete the form and return it to the client or employer, who will then use the information to generate a 1099-MISC form. The 1099-MISC form is used to report the contractor's income to the IRS and is typically filed by January 31st of each year. The contractor will also receive a copy of the 1099-MISC form, which they can use to report their income on their tax return.5 Ways the W9 Form Can Impact Your Business

The W9 form can have a significant impact on your business or career as a self-employed individual. Here are five ways the W9 form can affect your business:

- Tax Obligations: The W9 form helps to determine your tax obligations as a self-employed individual. By completing the form accurately, you can ensure that you are paying the correct amount of taxes and avoiding any potential penalties or fines.

- Client Relationships: The W9 form can also impact your relationships with clients. By providing accurate and up-to-date information, you can build trust with your clients and ensure that you are complying with IRS regulations.

- Financial Planning: The W9 form can also help with financial planning. By understanding your tax obligations and income, you can make informed decisions about your business and plan for the future.

- Compliance: The W9 form is an essential component of IRS compliance. By completing the form accurately and submitting it on time, you can ensure that you are complying with IRS regulations and avoiding any potential penalties or fines.

- Record-Keeping: Finally, the W9 form can help with record-keeping. By maintaining accurate and up-to-date records, you can ensure that you are reporting your income correctly and paying the correct amount of taxes.

Best Practices for Managing W9 Forms

To ensure that you are managing W9 forms effectively, it is essential to follow best practices. Here are some tips to help you manage W9 forms:- Keep Accurate Records: Maintain accurate and up-to-date records of all W9 forms completed and submitted.

- Verify Information: Verify the accuracy of all information provided on the W9 form.

- Submit on Time: Submit the W9 form on time to avoid any potential penalties or fines.

- Follow IRS Guidelines: Follow IRS guidelines and regulations when completing and submitting the W9 form.

- Seek Professional Advice: Seek professional advice if you are unsure about any aspect of the W9 form or IRS regulations.

Common Mistakes to Avoid When Completing the W9 Form

When completing the W9 form, it is essential to avoid common mistakes. Here are some mistakes to watch out for:

- Inaccurate Information: Providing inaccurate or outdated information can lead to delays or penalties.

- Incomplete Forms: Failing to complete all sections of the form can lead to delays or penalties.

- Incorrect Tax Classification: Incorrectly classifying your tax status can lead to errors in tax reporting and potential penalties.

- Failure to Sign: Failing to sign the form can lead to delays or penalties.

- Not Keeping Records: Failing to maintain accurate and up-to-date records of completed W9 forms can lead to errors in tax reporting and potential penalties.

Consequences of Not Completing the W9 Form

The consequences of not completing the W9 form can be severe. Here are some potential consequences:- Penalties and Fines: Failing to complete the W9 form can lead to penalties and fines from the IRS.

- Delayed Payments: Failing to complete the W9 form can lead to delayed payments from clients.

- Loss of Business: Failing to complete the W9 form can lead to a loss of business or reputation.

- Tax Audits: Failing to complete the W9 form can lead to tax audits and potential penalties.

- Legal Action: In severe cases, failing to complete the W9 form can lead to legal action.

W9 Form Image Gallery

What is the purpose of the W9 form?

+The W9 form is used to verify the identity and tax status of independent contractors and freelancers.

How do I complete the W9 form?

+To complete the W9 form, you will need to provide your name, address, tax identification number, and tax classification.

What are the consequences of not completing the W9 form?

+The consequences of not completing the W9 form can include penalties and fines, delayed payments, loss of business, tax audits, and legal action.

How do I submit the W9 form?

+The W9 form should be submitted to the client or employer, who will then use the information to generate a 1099-MISC form.

What are the benefits of completing the W9 form?

+The benefits of completing the W9 form include ensuring accurate tax reporting, avoiding penalties and fines, and building trust with clients.

In conclusion, the W9 form is a crucial document that plays a significant role in the tax reporting process for independent contractors and freelancers. By understanding the importance of the W9 form, completing it accurately, and submitting it on time, you can ensure that you are complying with IRS regulations and avoiding any potential penalties or fines. If you have any questions or concerns about the W9 form, do not hesitate to reach out to a tax professional or the IRS directly. We hope this article has provided you with a comprehensive understanding of the W9 form and its significance in the tax reporting process. Please feel free to share your thoughts or ask questions in the comments section below.