Intro

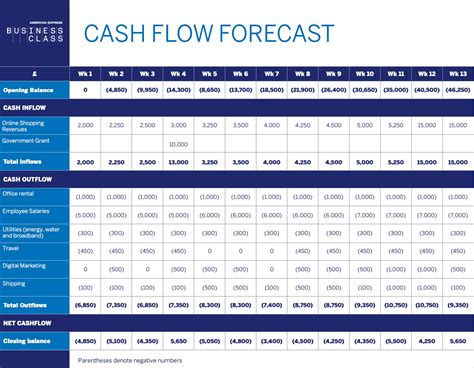

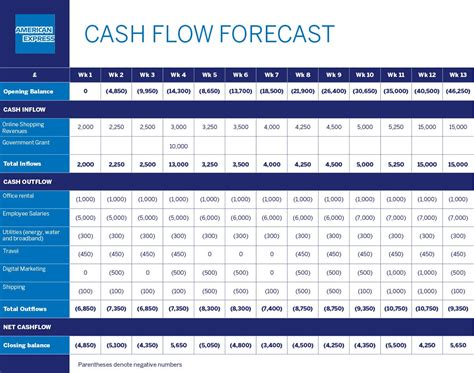

Boost financial management with a 13 Week Cash Flow Template, streamlining cash forecasting, budgeting, and liquidity analysis for improved fiscal control and smart business decisions.

Managing cash flow is essential for the survival and success of any business. A well-structured cash flow template can help businesses predict and manage their cash inflows and outflows, ensuring they have enough liquidity to meet their financial obligations. In this article, we will delve into the importance of cash flow management, the benefits of using a 13-week cash flow template, and provide a detailed guide on how to create and use this template effectively.

Effective cash flow management is critical for businesses of all sizes. It helps companies to anticipate and prepare for any financial challenges that may arise, ensuring they can continue to operate smoothly and achieve their goals. A 13-week cash flow template is a valuable tool that can help businesses to manage their cash flow over a short-term period, typically 13 weeks. This template provides a detailed and structured approach to cash flow forecasting, enabling businesses to make informed decisions about their financial resources.

The 13-week cash flow template is particularly useful for businesses that experience fluctuations in their cash flow, such as seasonal variations or uncertain revenue streams. By using this template, businesses can identify potential cash flow gaps and develop strategies to mitigate them, ensuring they have sufficient liquidity to meet their financial obligations. In the following sections, we will explore the benefits of using a 13-week cash flow template, how to create one, and provide practical examples of its application.

Benefits of a 13-Week Cash Flow Template

A 13-week cash flow template offers several benefits to businesses, including:

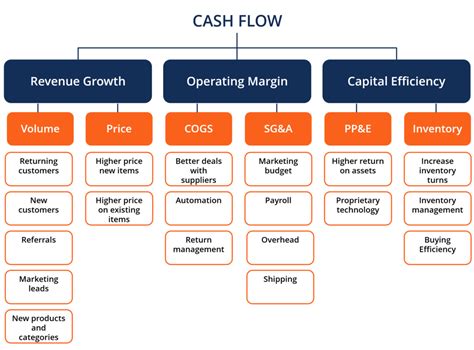

- Improved cash flow forecasting: The template provides a detailed and structured approach to cash flow forecasting, enabling businesses to anticipate and prepare for any financial challenges that may arise.

- Enhanced financial planning: By using the template, businesses can develop a comprehensive financial plan that takes into account their cash inflows and outflows, ensuring they have sufficient liquidity to meet their financial obligations.

- Increased transparency: The template provides a clear and transparent view of a business's cash flow, enabling stakeholders to make informed decisions about the company's financial resources.

- Better decision-making: The template enables businesses to make informed decisions about their financial resources, such as investing in new opportunities or managing debt.

Creating a 13-Week Cash Flow Template

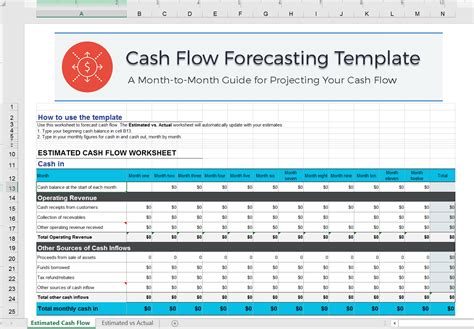

Creating a 13-week cash flow template involves several steps, including:

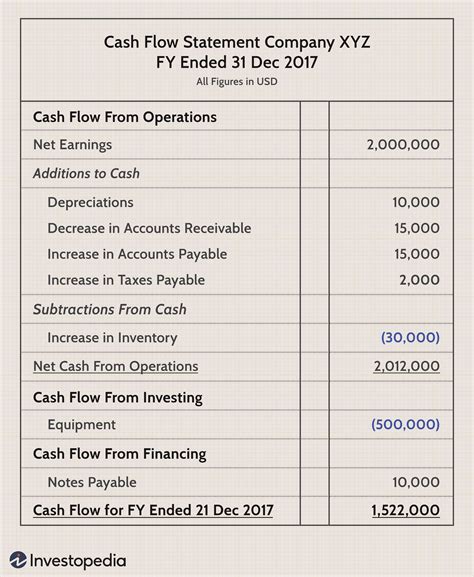

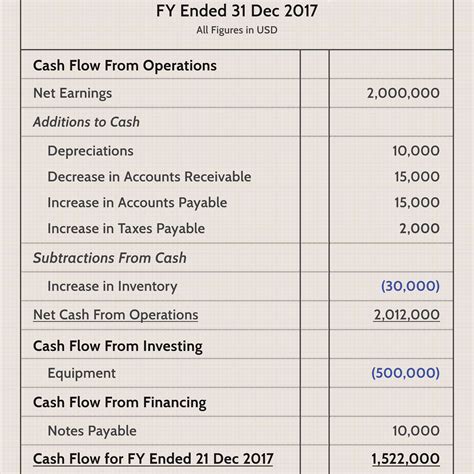

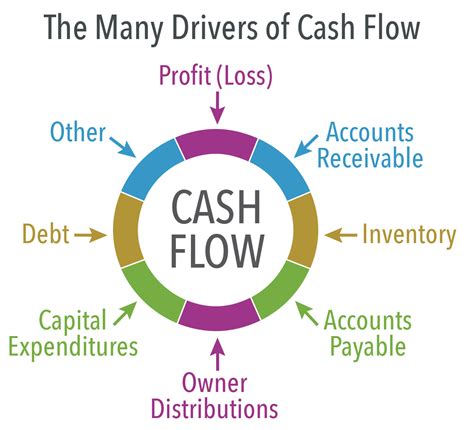

- Identifying cash inflows: Businesses should identify all potential cash inflows, such as revenue from sales, interest income, and investments.

- Identifying cash outflows: Businesses should identify all potential cash outflows, such as operating expenses, capital expenditures, and debt repayments.

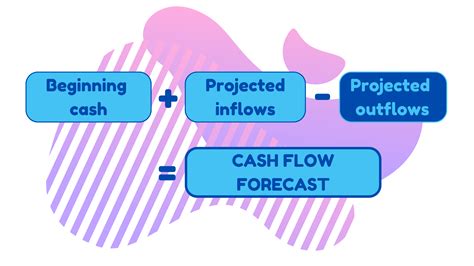

- Estimating cash flows: Businesses should estimate their cash inflows and outflows over the 13-week period, using historical data and industry trends to inform their forecasts.

- Calculating net cash flow: Businesses should calculate their net cash flow by subtracting their total cash outflows from their total cash inflows.

- Reviewing and revising: Businesses should regularly review and revise their cash flow forecast to ensure it remains accurate and relevant.

Key Components of a 13-Week Cash Flow Template

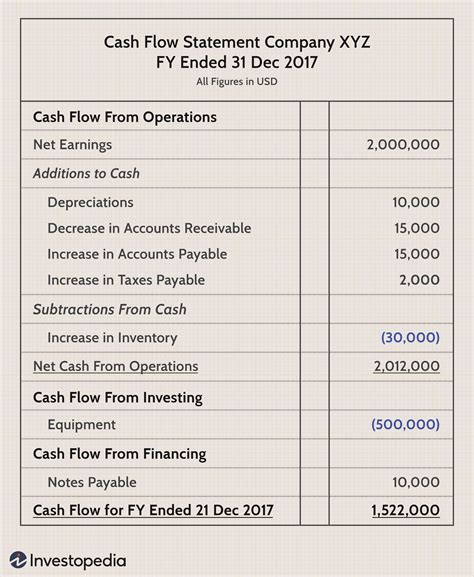

A 13-week cash flow template should include several key components, including: * Cash inflows: A list of all potential cash inflows, such as revenue from sales, interest income, and investments. * Cash outflows: A list of all potential cash outflows, such as operating expenses, capital expenditures, and debt repayments. * Net cash flow: A calculation of the business's net cash flow, which is the difference between its total cash inflows and total cash outflows. * Cumulative cash flow: A calculation of the business's cumulative cash flow, which is the running total of its net cash flow over the 13-week period.Using a 13-Week Cash Flow Template

Using a 13-week cash flow template involves several steps, including:

- Reviewing the template: Businesses should regularly review their cash flow template to ensure it remains accurate and relevant.

- Updating the template: Businesses should update their cash flow template to reflect any changes in their cash inflows or outflows.

- Analyzing the results: Businesses should analyze the results of their cash flow forecast to identify any potential cash flow gaps or opportunities.

- Developing strategies: Businesses should develop strategies to mitigate any potential cash flow gaps, such as reducing expenses or increasing revenue.

Best Practices for Using a 13-Week Cash Flow Template

There are several best practices that businesses should follow when using a 13-week cash flow template, including: * Regularly reviewing and updating the template to ensure it remains accurate and relevant. * Using historical data and industry trends to inform cash flow forecasts. * Identifying and mitigating potential cash flow gaps. * Developing strategies to optimize cash flow, such as reducing expenses or increasing revenue.Common Mistakes to Avoid

There are several common mistakes that businesses should avoid when using a 13-week cash flow template, including:

- Failing to regularly review and update the template.

- Using inaccurate or outdated data to inform cash flow forecasts.

- Failing to identify and mitigate potential cash flow gaps.

- Failing to develop strategies to optimize cash flow.

Conclusion and Next Steps

In conclusion, a 13-week cash flow template is a valuable tool that can help businesses to manage their cash flow effectively. By following the steps outlined in this article, businesses can create and use a 13-week cash flow template to anticipate and prepare for any financial challenges that may arise. Remember to regularly review and update the template, use accurate and up-to-date data, and develop strategies to optimize cash flow.Cash Flow Management Image Gallery

What is a 13-week cash flow template?

+A 13-week cash flow template is a tool used to manage and forecast cash flow over a 13-week period.

How do I create a 13-week cash flow template?

+To create a 13-week cash flow template, identify your cash inflows and outflows, estimate your cash flows, and calculate your net cash flow.

What are the benefits of using a 13-week cash flow template?

+The benefits of using a 13-week cash flow template include improved cash flow forecasting, enhanced financial planning, and increased transparency.

How often should I review and update my 13-week cash flow template?

+You should regularly review and update your 13-week cash flow template to ensure it remains accurate and relevant.

What are some common mistakes to avoid when using a 13-week cash flow template?

+Common mistakes to avoid include failing to regularly review and update the template, using inaccurate or outdated data, and failing to identify and mitigate potential cash flow gaps.

We hope this article has provided you with a comprehensive understanding of the importance of cash flow management and the benefits of using a 13-week cash flow template. By following the steps outlined in this article and avoiding common mistakes, you can create and use a 13-week cash flow template to effectively manage your cash flow and achieve your business goals. If you have any further questions or would like to share your experiences with using a 13-week cash flow template, please comment below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.