Intro

Boost financial planning with a 13 Week Cash Flow Excel Template, streamlining budgeting, forecasting, and cash management for improved liquidity and fiscal control.

Managing cash flow is crucial for the success of any business. A 13-week cash flow template is a valuable tool that helps businesses predict and manage their cash inflows and outflows over a short-term period, typically 13 weeks. This template is particularly useful for small businesses, startups, and entrepreneurs who need to closely monitor their cash flow to ensure they have enough liquidity to meet their financial obligations.

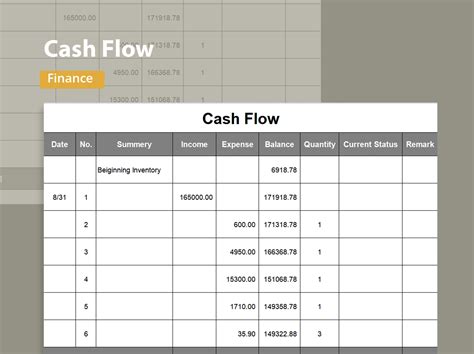

A 13-week cash flow template typically includes columns for the date, cash inflows, cash outflows, and the resulting cash balance. By filling out this template on a weekly basis, businesses can forecast their cash flow and make informed decisions about their financial management. This can help businesses avoid cash flow problems, such as running out of money to pay bills or meet payroll obligations.

In this article, we will explore the importance of a 13-week cash flow template, its benefits, and how to create one using Excel. We will also provide tips and examples to help businesses get the most out of this valuable tool.

Benefits of a 13-Week Cash Flow Template

A 13-week cash flow template offers several benefits to businesses, including:

- Improved cash flow forecasting: By tracking cash inflows and outflows over a 13-week period, businesses can better predict their cash flow and make informed decisions about their financial management.

- Enhanced financial planning: A 13-week cash flow template helps businesses identify areas where they can improve their cash flow, such as by reducing expenses or increasing sales.

- Better decision-making: With a clear picture of their cash flow, businesses can make better decisions about investments, funding, and other financial matters.

- Reduced financial stress: By avoiding cash flow problems, businesses can reduce their financial stress and focus on growing and developing their operations.

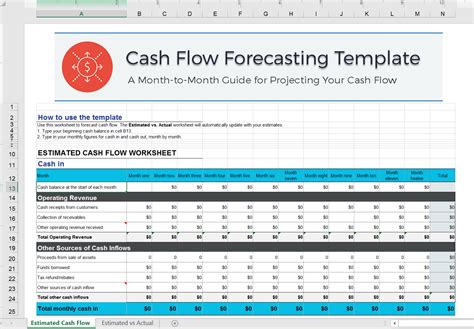

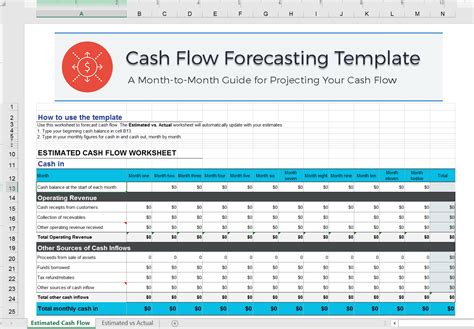

How to Create a 13-Week Cash Flow Template in Excel

Creating a 13-week cash flow template in Excel is a straightforward process. Here are the steps to follow:

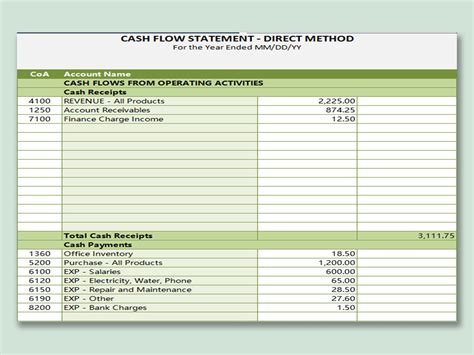

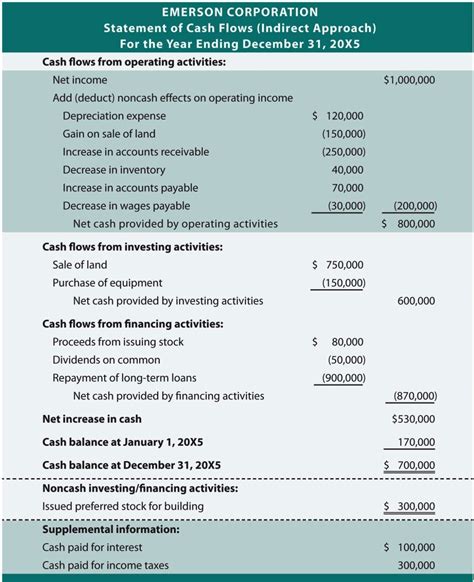

- Open a new Excel spreadsheet and set up a table with the following columns: Date, Cash Inflows, Cash Outflows, and Cash Balance.

- Enter the dates for the next 13 weeks in the Date column.

- Enter the expected cash inflows for each week in the Cash Inflows column. This can include sales, accounts receivable, and other sources of income.

- Enter the expected cash outflows for each week in the Cash Outflows column. This can include expenses, accounts payable, and other financial obligations.

- Calculate the cash balance for each week by subtracting the cash outflows from the cash inflows and adding the result to the previous week's cash balance.

- Use formulas and formatting to make the template easy to read and understand.

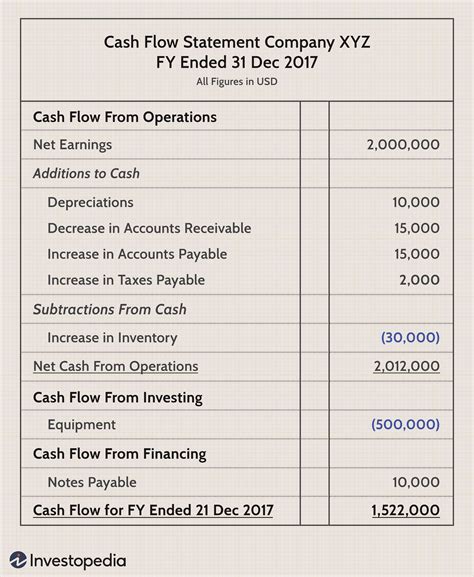

Example of a 13-Week Cash Flow Template

Here is an example of what a 13-week cash flow template might look like:

| Date | Cash Inflows | Cash Outflows | Cash Balance |

|---|---|---|---|

| Week 1 | $10,000 | $5,000 | $5,000 |

| Week 2 | $12,000 | $6,000 | $11,000 |

| Week 3 | $15,000 | $8,000 | $18,000 |

| ... | ... | ... | ... |

| Week 13 | $20,000 | $10,000 | $30,000 |

Tips for Using a 13-Week Cash Flow Template

Here are some tips for using a 13-week cash flow template:

- Regularly update the template: Make sure to update the template every week to reflect changes in cash inflows and outflows.

- Be realistic: Make sure to be realistic when forecasting cash inflows and outflows. Avoid overestimating sales or underestimating expenses.

- Consider multiple scenarios: Consider creating multiple scenarios to account for different possible outcomes, such as a best-case scenario and a worst-case scenario.

- Review and adjust: Regularly review the template and adjust as needed to ensure that it is accurate and effective.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using a 13-week cash flow template:

- Failing to regularly update the template

- Overestimating cash inflows or underestimating cash outflows

- Failing to consider multiple scenarios

- Not reviewing and adjusting the template regularly

Conclusion and Next Steps

In conclusion, a 13-week cash flow template is a valuable tool for businesses to manage their cash flow and make informed financial decisions. By following the steps outlined in this article, businesses can create their own 13-week cash flow template and start improving their cash flow forecasting and financial planning.

Next steps:

- Create a 13-week cash flow template using Excel

- Regularly update the template to reflect changes in cash inflows and outflows

- Review and adjust the template regularly to ensure that it is accurate and effective

Cash Flow Image Gallery

What is a 13-week cash flow template?

+A 13-week cash flow template is a tool used to forecast and manage cash inflows and outflows over a 13-week period.

How do I create a 13-week cash flow template in Excel?

+To create a 13-week cash flow template in Excel, set up a table with columns for date, cash inflows, cash outflows, and cash balance, and enter the expected cash inflows and outflows for each week.

What are the benefits of using a 13-week cash flow template?

+The benefits of using a 13-week cash flow template include improved cash flow forecasting, enhanced financial planning, better decision-making, and reduced financial stress.

How often should I update my 13-week cash flow template?

+You should update your 13-week cash flow template regularly, ideally on a weekly basis, to reflect changes in cash inflows and outflows.

What are some common mistakes to avoid when using a 13-week cash flow template?

+Common mistakes to avoid when using a 13-week cash flow template include failing to regularly update the template, overestimating cash inflows or underestimating cash outflows, and failing to consider multiple scenarios.

We hope this article has provided you with a comprehensive understanding of the importance of a 13-week cash flow template and how to create one using Excel. By following the tips and best practices outlined in this article, you can improve your cash flow forecasting and financial planning, and make informed decisions about your business. If you have any questions or comments, please don't hesitate to reach out. Share this article with your colleagues and friends, and help them improve their cash flow management.