Intro

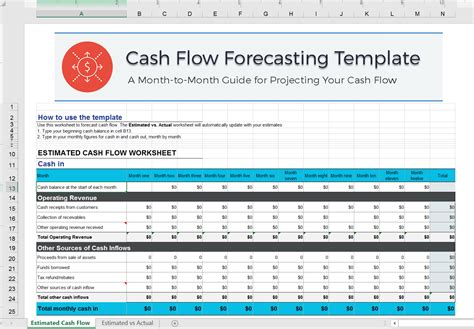

Streamline financial planning with 12 Month Cash Flow Templates, featuring budgeting tools, forecasting models, and expense trackers to optimize cash management and improve liquidity analysis.

Managing cash flow is essential for the financial health and sustainability of any business. A 12-month cash flow template is a vital tool that helps businesses predict and manage their cash inflows and outflows over a year. This enables them to make informed decisions about investments, funding, and operational expenses. In this article, we will delve into the importance of cash flow management, the benefits of using a 12-month cash flow template, and provide a comprehensive guide on how to create and utilize one effectively.

Effective cash flow management is crucial because it helps businesses avoid cash shortages, plan for future expenditures, and identify opportunities for growth. A cash flow template, particularly one that covers a 12-month period, offers a detailed and structured approach to forecasting cash movements. This tool is indispensable for startups, small businesses, and large corporations alike, as it aids in budgeting, financial planning, and strategic decision-making.

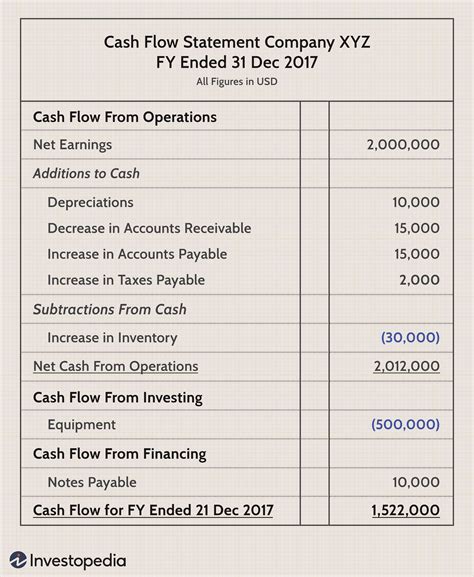

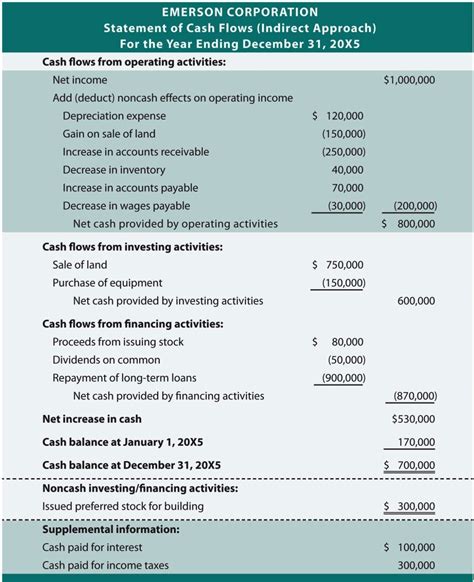

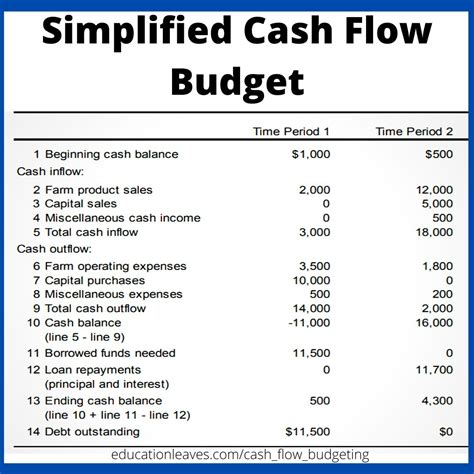

A 12-month cash flow template typically includes columns for each month of the year, with rows for different categories of cash inflows and outflows. Inflows might include sales revenue, loans, and investments, while outflows could encompass salaries, rent, utilities, and purchase of goods or equipment. By filling out these templates, businesses can visualize their cash position at any point during the year, anticipate potential cash flow problems, and take proactive measures to mitigate them.

Introduction to Cash Flow Management

Cash flow management involves tracking the amount of money coming into and going out of a business. It's about ensuring that a company has enough cash on hand to meet its financial obligations and invest in opportunities for growth. Effective cash flow management can make the difference between a business thriving and one that struggles to stay afloat.

Benefits of Cash Flow Templates

Cash flow templates offer several benefits, including:

- Improved Financial Forecasting: They help businesses predict their future cash position, allowing for better planning and decision-making.

- Enhanced Budgeting: By understanding where money is coming from and going, businesses can create more accurate budgets.

- Reduced Financial Risk: Anticipating cash flow issues enables businesses to take steps to avoid them, reducing the risk of insolvency.

- Increased Efficiency: Automating cash flow forecasting with templates can save time and reduce the likelihood of human error.

Creating a 12-Month Cash Flow Template

Creating a 12-month cash flow template involves several steps:

- Identify Cash Inflows: List all potential sources of income, such as sales, investments, and loans.

- Identify Cash Outflows: Enumerate all expenses, including fixed costs like rent and salaries, and variable costs like materials and marketing.

- Estimate Monthly Cash Flows: Based on historical data and future projections, estimate the monthly cash inflows and outflows.

- Calculate Net Cash Flow: For each month, subtract total outflows from total inflows to find the net cash flow.

- Review and Adjust: Regularly review the template and adjust projections as necessary based on actual cash flow performance.

Steps to Implement a Cash Flow Template

Implementing a cash flow template effectively requires:

- Regular Updates: Ensure that the template is updated monthly to reflect actual cash flows and adjust future projections.

- Continuous Monitoring: Keep a close eye on cash flow to identify and address any discrepancies between projected and actual cash flows.

- Strategic Decision-Making: Use the insights from the cash flow template to make informed decisions about investments, funding, and operational adjustments.

Benefits of Using a 12-Month Cash Flow Template

Using a 12-month cash flow template offers numerous benefits, including:

- Long-Term Planning: It enables businesses to plan for the long term, making strategic decisions about growth and investment.

- Financial Stability: By anticipating and preparing for cash flow fluctuations, businesses can maintain financial stability.

- Growth Opportunities: Identifying periods of positive cash flow can highlight opportunities for expansion or investment.

Practical Applications of Cash Flow Templates

In practical terms, a 12-month cash flow template can be used to:

- Manage Seasonal Variations: For businesses with seasonal fluctuations in sales, a cash flow template can help manage these variations.

- Plan for Large Expenses: It can assist in planning and saving for large, one-off expenses, such as equipment purchases or lease payments.

- Evaluate Funding Options: By understanding future cash flow, businesses can evaluate the need for and viability of different funding options.

Common Challenges in Cash Flow Management

Despite the benefits, businesses may face challenges in managing their cash flow, including:

- Inaccurate Forecasting: Overestimating sales or underestimating expenses can lead to cash flow problems.

- Late Payments: Delays in receiving payments from customers can severely impact cash flow.

- Unexpected Expenses: Unforeseen expenses can quickly deplete a company's cash reserves.

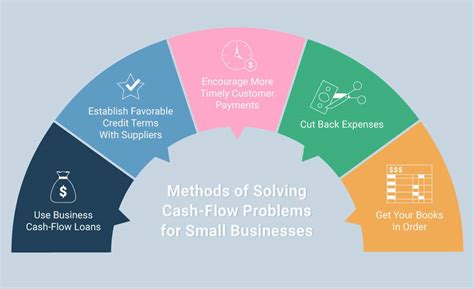

Overcoming Cash Flow Challenges

To overcome these challenges, businesses can:

- Implement Strict Credit Control: Ensuring that customers pay on time can significantly improve cash flow.

- Maintain an Emergency Fund: Having a cash reserve can provide a buffer against unexpected expenses or late payments.

- Regularly Review and Adjust Projections: Staying on top of financial forecasting can help businesses adapt to changing circumstances.

Technology and Cash Flow Management

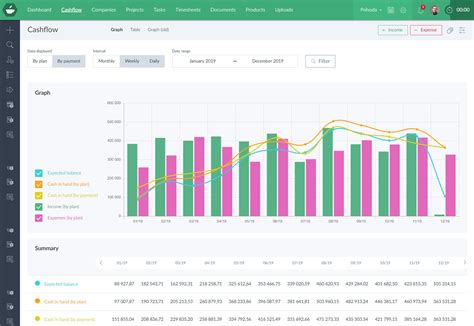

Technology plays a crucial role in modern cash flow management, offering tools and software that can:

- Automate Forecasting: Using historical data and algorithms, software can predict future cash flows with a high degree of accuracy.

- Streamline Invoicing and Payments: Online invoicing and payment systems can reduce the time it takes to receive payments.

- Provide Real-Time Insights: Cloud-based accounting software can offer real-time views of a company's cash position, enabling swift decision-making.

Leveraging Technology for Cash Flow Management

Businesses can leverage technology by:

- Adopting Cloud Accounting: Moving to cloud-based accounting systems can provide real-time financial data and automate many cash flow management tasks.

- Implementing Cash Flow Software: Specialized cash flow management software can offer advanced forecasting and scenario planning tools.

- Utilizing Online Payment Systems: Encouraging customers to use online payment methods can speed up the payment process.

Conclusion and Future Directions

In conclusion, a 12-month cash flow template is a powerful tool for managing a business's financial health. By understanding the benefits, creating an effective template, and leveraging technology, businesses can navigate the complexities of cash flow management. As the business landscape continues to evolve, the importance of proactive cash flow management will only grow, making the use of such templates an indispensable practice for businesses aiming to thrive.

Cash Flow Management Image Gallery

What is a 12-month cash flow template?

+A 12-month cash flow template is a tool used to forecast and manage a business's cash inflows and outflows over a year.

Why is cash flow management important?

+Cash flow management is crucial for ensuring a business has enough cash to meet its financial obligations and invest in growth opportunities.

How can technology aid in cash flow management?

+Technology can automate forecasting, streamline invoicing and payments, and provide real-time insights into a company's cash position.

We hope this comprehensive guide to 12-month cash flow templates has been informative and helpful. Whether you're a seasoned business owner or just starting out, understanding and effectively managing your cash flow is key to success. Share your thoughts on cash flow management and how you utilize templates in your business practices in the comments below. Don't forget to share this article with anyone who might benefit from learning more about this critical aspect of business finance.