Intro

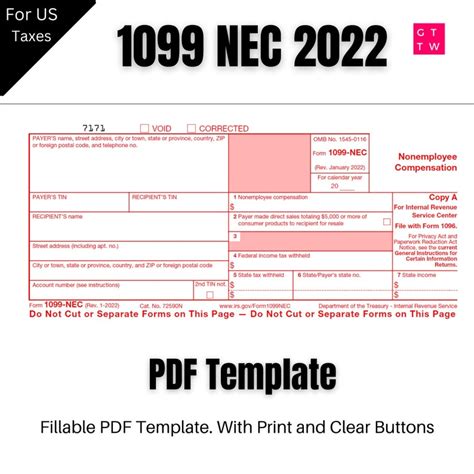

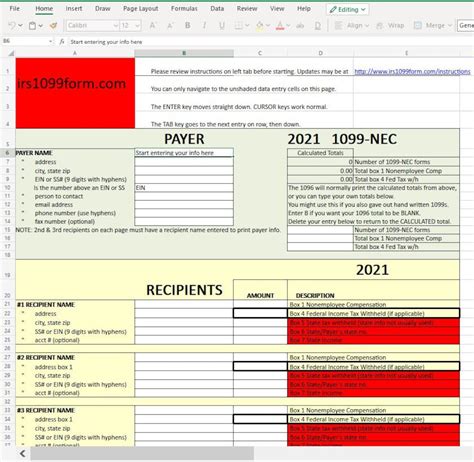

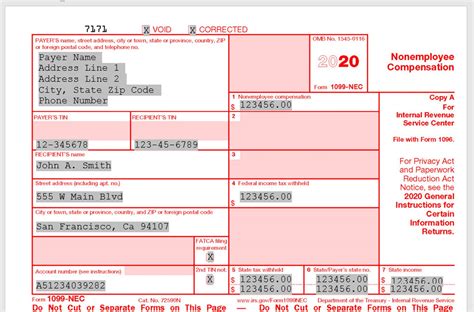

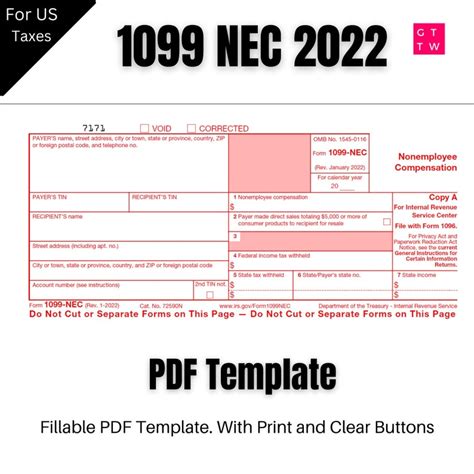

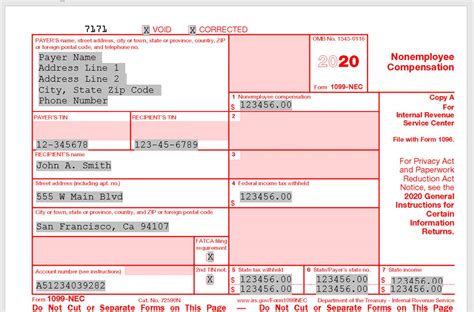

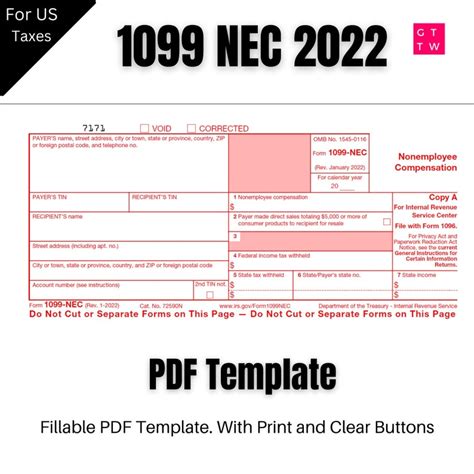

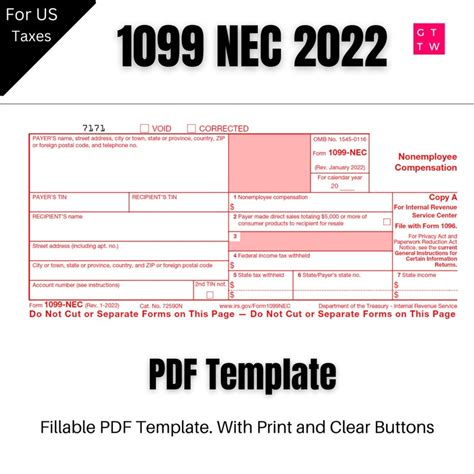

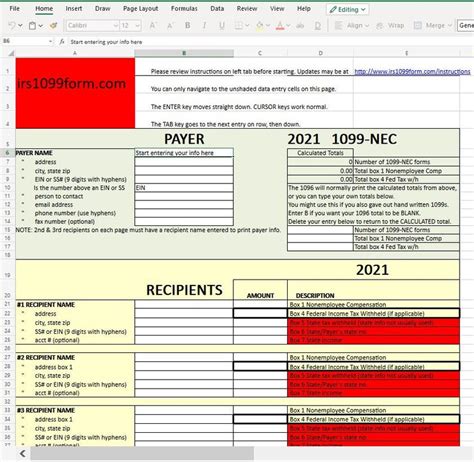

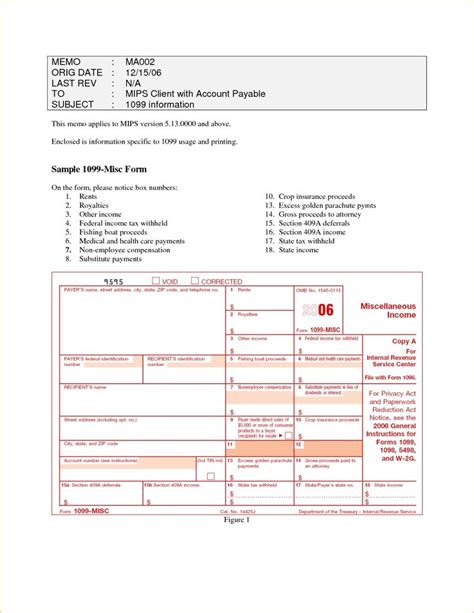

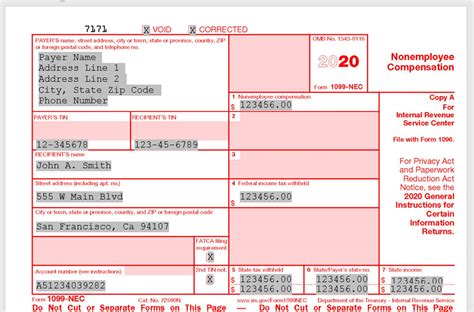

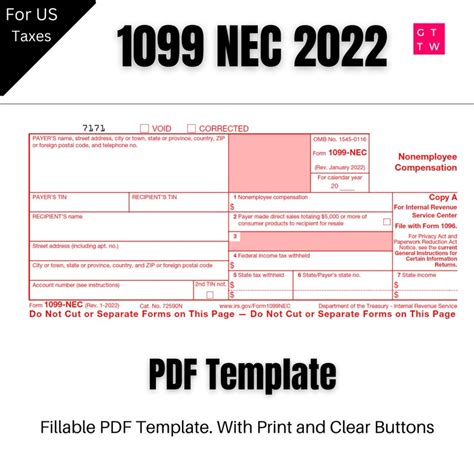

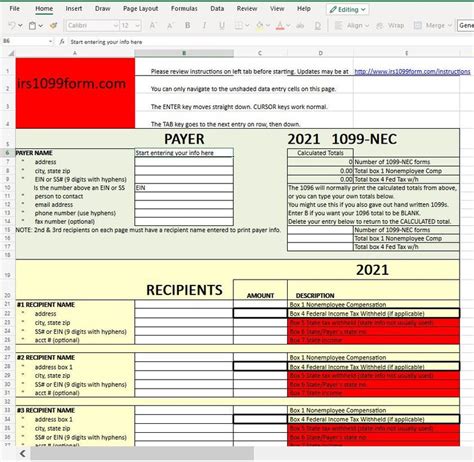

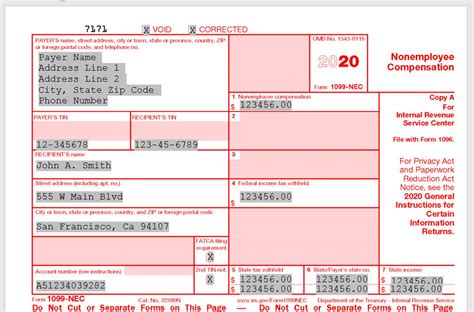

Get 5 free 1099 NEC templates for independent contractors, freelancers, and self-employed individuals, including fillable forms, IRS compliant templates, and sample invoices for accurate tax reporting and record-keeping.

The 1099 NEC form is a crucial document for businesses and individuals who need to report non-employee compensation to the Internal Revenue Service (IRS). As a business owner or accountant, you may be looking for free 1099 NEC templates to simplify the process of creating and filing these forms. In this article, we will discuss the importance of 1099 NEC forms, the benefits of using templates, and provide five free templates that you can use.

The 1099 NEC form is used to report non-employee compensation, such as payments made to independent contractors, freelancers, and other non-employees. This form is essential for tax compliance, and failure to file it accurately and on time can result in penalties and fines. Using a template can help you create and file the 1099 NEC form quickly and efficiently, ensuring that you meet the IRS deadlines and avoid any potential penalties.

Benefits of Using 1099 NEC Templates

5 Free 1099 NEC Templates

How to Use 1099 NEC Templates

Tips for Filing 1099 NEC Forms

Common Mistakes to Avoid

Gallery of 1099 NEC Templates

1099 NEC Templates Image Gallery

Frequently Asked Questions

What is a 1099 NEC form?

+A 1099 NEC form is used to report non-employee compensation, such as payments made to independent contractors, freelancers, and other non-employees.

Who needs to file a 1099 NEC form?

+Businesses and individuals who make payments to non-employees, such as independent contractors and freelancers, need to file a 1099 NEC form.

What is the deadline for filing 1099 NEC forms?

+The deadline for filing 1099 NEC forms is typically January 31st of each year.

Can I file 1099 NEC forms electronically?

+Yes, you can file 1099 NEC forms electronically through the IRS website or through a third-party provider.

What are the penalties for not filing 1099 NEC forms?

+The penalties for not filing 1099 NEC forms can include fines and interest on the amount of tax owed.

We hope this article has provided you with a comprehensive overview of 1099 NEC templates and how to use them. By following the tips and guidelines outlined in this article, you can ensure that you are filing your 1099 NEC forms accurately and on time, avoiding any potential penalties and fines. If you have any further questions or need additional assistance, please don't hesitate to reach out. Share this article with your colleagues and friends who may benefit from this information, and leave a comment below with your thoughts and experiences with 1099 NEC templates.