Intro

Create accurate pay stubs with a 1099 employee pay stub template, featuring independent contractor, freelance, and self-employed income details, deductions, and taxes.

As a business owner, managing employee payments and maintaining accurate records is crucial for compliance with tax laws and regulations. One essential tool for achieving this is a pay stub template, specifically designed for 1099 employees. In this article, we will delve into the importance of pay stubs for 1099 employees, the benefits of using a template, and provide a comprehensive guide on how to create and use a 1099 employee pay stub template.

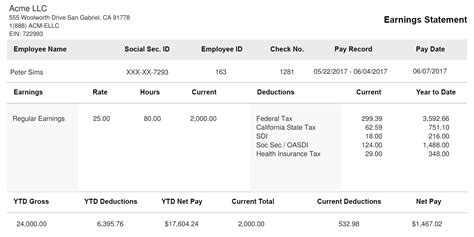

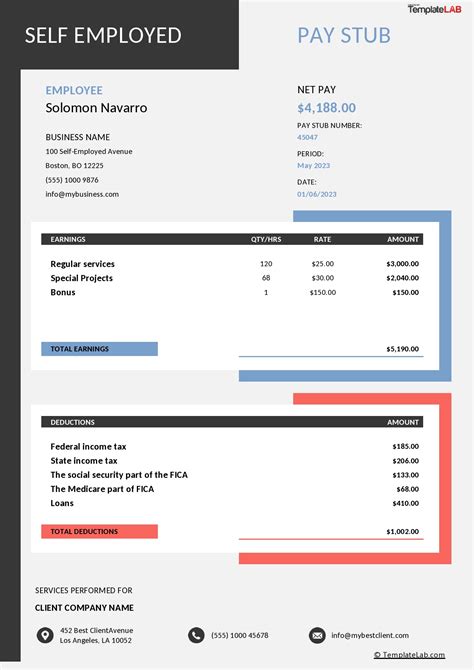

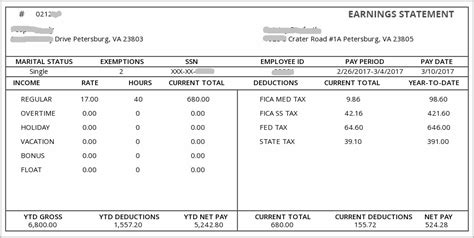

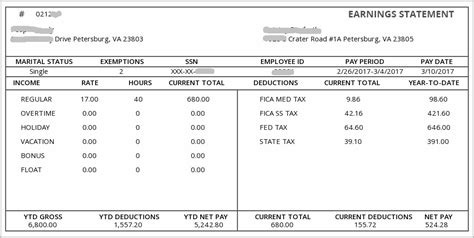

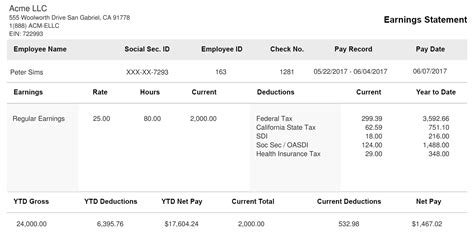

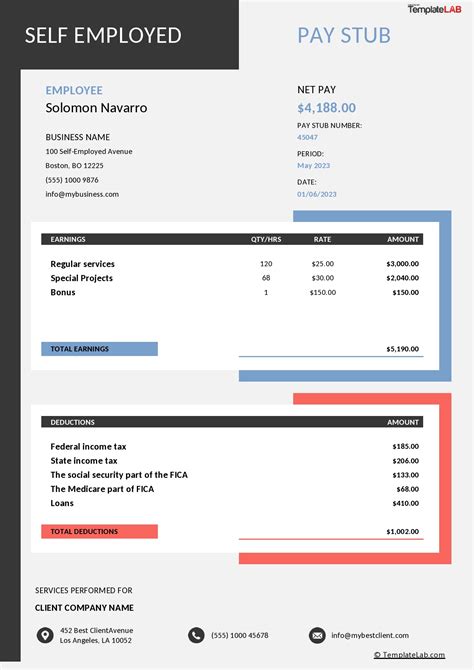

A pay stub, also known as a paycheck stub, is a document that provides details about an employee's pay, including gross earnings, deductions, and net pay. For 1099 employees, who are considered independent contractors, a pay stub serves as a record of their earnings and is essential for tax purposes. The IRS requires businesses to provide 1099 employees with a Form 1099-MISC, which reports their annual earnings, but a pay stub template can help streamline the payment process and provide additional details.

Using a 1099 employee pay stub template offers several benefits, including increased efficiency, accuracy, and compliance with tax regulations. A template can help businesses save time and reduce errors, as it provides a standardized format for calculating and recording employee payments. Additionally, a pay stub template can help ensure that all necessary information is included, such as employee details, payment dates, and deductions.

Understanding 1099 Employee Pay Stub Requirements

When creating a 1099 employee pay stub template, it's essential to understand the requirements and regulations surrounding independent contractor payments. The IRS provides guidelines for reporting 1099 employee earnings, and businesses must comply with these regulations to avoid penalties. Some key requirements include:

- Reporting annual earnings: Businesses must report 1099 employee earnings on Form 1099-MISC, which is due by January 31st of each year.

- Providing employee details: The pay stub template should include the employee's name, address, and tax identification number.

- Calculating gross earnings: The template should calculate the employee's gross earnings, including any fees, commissions, or other forms of payment.

- Deductions: The template should account for any deductions, such as taxes, insurance, or other benefits.

Benefits of Using a 1099 Employee Pay Stub Template

Using a 1099 employee pay stub template offers several benefits, including:

- Increased efficiency: A template can help streamline the payment process, reducing the time and effort required to calculate and record employee payments.

- Accuracy: A template can help reduce errors, ensuring that all necessary information is included and calculations are accurate.

- Compliance: A template can help businesses comply with tax regulations, reducing the risk of penalties and fines.

- Organization: A template can help businesses keep track of employee payments, making it easier to manage records and prepare for tax season.

Creating a 1099 Employee Pay Stub Template

To create a 1099 employee pay stub template, businesses can follow these steps:

- Determine the necessary information: Identify the information required for the pay stub, including employee details, payment dates, and deductions.

- Choose a template format: Select a template format that is easy to use and understand, such as a spreadsheet or word processing document.

- Calculate gross earnings: Create a formula to calculate the employee's gross earnings, including any fees, commissions, or other forms of payment.

- Account for deductions: Create a formula to account for any deductions, such as taxes, insurance, or other benefits.

- Test the template: Test the template to ensure it is accurate and easy to use.

Using a 1099 Employee Pay Stub Template

To use a 1099 employee pay stub template, businesses can follow these steps:

- Enter employee details: Enter the employee's name, address, and tax identification number.

- Calculate gross earnings: Use the template to calculate the employee's gross earnings.

- Account for deductions: Use the template to account for any deductions.

- Review and verify: Review and verify the pay stub to ensure it is accurate and complete.

- Provide to employee: Provide the pay stub to the employee, either electronically or in print.

Best Practices for 1099 Employee Pay Stub Templates

To ensure accuracy and compliance, businesses should follow these best practices when using a 1099 employee pay stub template:

- Use a standardized format: Use a standardized format for all pay stubs to ensure consistency and accuracy.

- Keep records: Keep accurate records of all pay stubs, including employee details and payment information.

- Review and verify: Review and verify each pay stub to ensure it is accurate and complete.

- Provide clear instructions: Provide clear instructions to employees on how to read and understand their pay stubs.

- Stay up-to-date: Stay up-to-date with tax regulations and laws to ensure compliance.

Gallery of 1099 Employee Pay Stub Templates

1099 Employee Pay Stub Template Gallery

What is a 1099 employee pay stub template?

+A 1099 employee pay stub template is a document used to record and calculate payments for independent contractors, including gross earnings, deductions, and net pay.

Why do I need a 1099 employee pay stub template?

+A 1099 employee pay stub template helps businesses streamline the payment process, reduce errors, and comply with tax regulations, ensuring accurate and timely payments to independent contractors.

How do I create a 1099 employee pay stub template?

+To create a 1099 employee pay stub template, determine the necessary information, choose a template format, calculate gross earnings, account for deductions, and test the template to ensure accuracy and ease of use.

In

Final Thoughts

Using a 1099 employee pay stub template can help businesses streamline the payment process, reduce errors, and comply with tax regulations. By understanding the requirements and regulations surrounding independent contractor payments, businesses can create an effective template that meets their needs. Whether you're a small business or a large corporation, a 1099 employee pay stub template is an essential tool for managing employee payments and maintaining accurate records. We encourage you to share your thoughts and experiences with using 1099 employee pay stub templates in the comments below. Don't forget to share this article with your colleagues and friends who may benefit from learning more about 1099 employee pay stub templates.