Intro

Boost savings with the 100 Day Savings Challenge, a financial discipline strategy using daily savings plans, budgeting tips, and money management techniques to achieve short-term goals and long-term financial stability.

Saving money is a crucial aspect of personal finance, and it's essential to develop healthy financial habits to achieve long-term stability. One popular method to encourage savings is the 100 Day Savings Challenge. This challenge is designed to help individuals build a savings habit and reach their financial goals in a short period. The concept is simple: save a specific amount of money each day for 100 days. The amount can be as little as $1 per day or as much as you can afford. The key is to be consistent and make saving a priority.

The 100 Day Savings Challenge is an excellent way to kickstart your savings journey, especially for those who struggle with saving money. It's a great way to develop a savings habit, and the sense of accomplishment you'll feel at the end of the challenge will motivate you to continue saving. Moreover, this challenge can be adapted to fit your financial goals and needs. You can adjust the amount you save each day or set a specific goal, such as saving for a emergency fund, a vacation, or a big purchase.

The benefits of the 100 Day Savings Challenge are numerous. Firstly, it helps you develop a savings habit, which is essential for long-term financial stability. Secondly, it allows you to save a significant amount of money in a short period, which can be used to achieve your financial goals. Thirdly, it teaches you the importance of discipline and consistency in saving money. By committing to save a specific amount each day, you'll learn to prioritize your finances and make saving a non-negotiable part of your daily routine.

How to Start the 100 Day Savings Challenge

Benefits of the 100 Day Savings Challenge

The benefits of the 100 Day Savings Challenge are numerous. Some of the advantages include: * Developing a savings habit: The challenge helps you build a consistent savings habit, which is essential for long-term financial stability. * Saving a significant amount: By saving a specific amount each day, you'll be able to accumulate a significant amount of money in a short period. * Improving financial discipline: The challenge teaches you the importance of discipline and consistency in saving money. * Reducing debt: You can use the money saved during the challenge to pay off high-interest debt or build an emergency fund. * Increasing financial awareness: The challenge helps you become more aware of your spending habits and financial goals.Tips to Succeed in the 100 Day Savings Challenge

Common Mistakes to Avoid

Some common mistakes to avoid during the 100 Day Savings Challenge include: * Not setting a specific goal: Failing to define what you want to achieve with the challenge can lead to a lack of motivation and direction. * Not automating your savings: Failing to set up automatic transfers can make it easier to neglect your savings. * Dipping into your savings: Using your savings for non-essential expenses can undermine your progress and make it harder to reach your goals. * Not tracking your progress: Failing to monitor your progress can make it harder to stay motivated and adjust your strategy as needed.100 Day Savings Challenge Variations

Conclusion and Next Steps

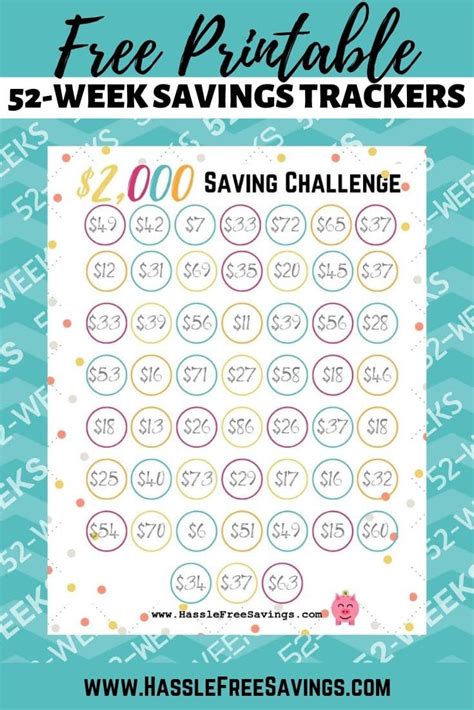

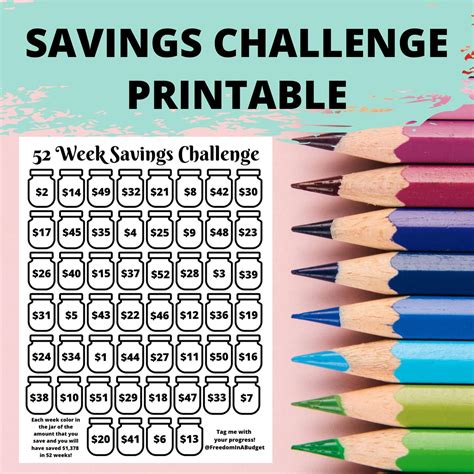

In conclusion, the 100 Day Savings Challenge is a great way to kickstart your savings journey and develop healthy financial habits. By following the tips and avoiding common mistakes, you can succeed in the challenge and achieve your financial goals. Remember to stay motivated, track your progress, and adjust your strategy as needed. After completing the challenge, consider continuing to save and investing your money to achieve long-term financial stability.Gallery of 100 Day Savings Challenge

100 Day Savings Challenge Image Gallery

What is the 100 Day Savings Challenge?

+The 100 Day Savings Challenge is a savings challenge where you save a specific amount of money each day for 100 days.

How do I start the 100 Day Savings Challenge?

+To start the challenge, determine how much you can afford to save each day and set up a separate savings account or use an existing one to track your progress.

What are the benefits of the 100 Day Savings Challenge?

+The benefits of the challenge include developing a savings habit, saving a significant amount of money, improving financial discipline, and reducing debt.

Can I customize the 100 Day Savings Challenge to fit my needs?

+Yes, you can customize the challenge to fit your needs by adjusting the amount you save each day or setting a specific goal.

How can I stay motivated during the 100 Day Savings Challenge?

+You can stay motivated by tracking your progress, setting reminders, and rewarding yourself for reaching milestones.

We hope this article has inspired you to take control of your finances and start saving. Remember to share your progress and tips with friends and family, and don't hesitate to reach out if you have any questions or need further guidance. Start your 100 Day Savings Challenge today and take the first step towards achieving your financial goals!